स्टार लघु उद्यमी समेकित ऋण

Micro & Small Enterprises in rural, semi urban, urban and metro branches

Investment and working capital requirements. This product will be offered to those Micro & Small Enterprises who require both working capital and term/demand loan

Composite Loan in the Form of Demand/Term Loan

| For units located in | Maximum amount of loan |

|---|---|

| Rural Areas | Rs. 5,00,000/- |

| Semi-urban Areas | Rs 10,00,000/- |

| Urban Areas | Rs. 50,00,000/- |

| Metro Areas | Rs. 100,00,000/- |

15%

As applicable

Hypothecation of Assets crated out of bank finance as well as existing unencumbered assets of the MSE unit.

- Equitable Mortgage of Land/Land & Building which is part of the business activity such as business premises

- Guarantee Cover under CGTMSE Guarantee Scheme. No collateral security/third party guarantee to be obtained

Loan is to be repaid in maximum 5 years with a moratorium of 3 to 6 months to be determined on the merits of the case

As applicable

उत्पाद जो आपको पसंद आ सकते हैं

स्टार एमएसएमई एजुकेशन प्लस

भवन का निर्माण, मरम्मत और नवीनीकरण, फर्नीचर और फिक्सचर और कंप्यूटर की खरीद।

अधिक जानें

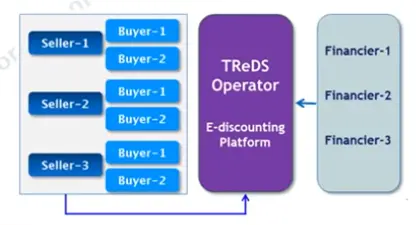

टीआरईडीएस (ट्रेड रिसीवेबल्स ई-डिस्काउंटिंग सिस्टम)

TReDs (व्यापार प्राप्य ई-डिस्काउंटिंग सिस्टम)

अधिक जानें