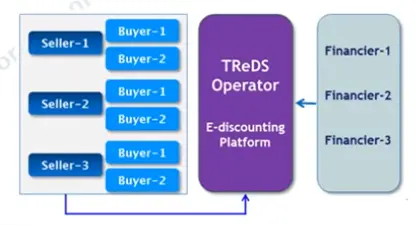

TReDS Mechanism:

- TReDS is an online mechanism for facilitating the financing of trade receivables of MSMEs through multiple financiers. It also enables discounting of invoices of MSME sellers raised against large corporate, allowing them to reduce working capital needs. It is an extended version of factoring on an electronic platform with multiple financiers.

- Facilitates provisions of finance against Invoices.

- Provides standardized process for on-boarding.

- Sellers Deliver goods on credit, Issue Invoices (called “Factoring Unit”-FU) and uploads it on TReDS.

- Buyers (Corporate/PSEs) log in TReDS and flag FU as accepted.

- On acceptance of FU, TReDS sends information to buyer’s bank . Buyers account is linked to FU.

- Sellers can opt for a bid quoted by the financier

- Funds credited to Seller’s account on T+1 day basis

- On due date TReDS sends message for payment of due amount from buyers account

- Non-Payment Is treated as default on buyer.

- Financier has no recourse against MSME Seller.

- Legally FU is similar to physical instrument under NI Act/Factoring Reg. Act 2011

PRODUCTS YOU MAY LIKE

Star MSME GST Plus

To meet the need based WC requirements of trading /services and manufacturing business.

Learn More

Star MSME Education Plus

Construction, repair and renovation of building, purchase of Furniture & Fixtures and Computers.

Learn More

TReDs(Trade-Receivables-E-Discounting-System)

.gif)