NPS

TYPES OF ACCOUNTS

Under NPS account, two sub-accounts – Tier I & II are provided. Tier I account is mandatory and the Subscriber has option to opt for Tier II account opening and operation. Tier II account can be opened only when Tier I account exists.

NPS

TIER 1

A retirement and pension account which can be withdrawn only upon meeting the exit conditions prescribed under NPS by PFRDA. The applicant shall contribute his/her savings for retirement into this account. This is the retirement account and applicant can claim tax benefits against the contributions made subject to the Income Tax rules in force.

- MINIMUM INITIAL CONTRIBUTION Rs 500

- MINIMUM YEARLY CONTRIBUTION Rs 1000

- There is no upper limit for the maximum contribution

NPS

TIER 2

This is a voluntary investment facility. The applicants are free to withdraw his/her savings from this account whenever he/she wishes. This is not a retirement account and applicant can’t claim any tax benefits against contributions to this account.

AVAILABLE ONLY AFTER TIER 1

- MINIMUM INITIAL CONTRIBUTION Rs 1000

- MINIMUM YEARLY CONTRIBUTION Rs NIL

- There is no upper limit for the maximum contribution

NPS

The investor has 2 Investment options for managing the fund: Auto and Active.

Auto Choice

This is the default option under NPS and wherein the management of investment of fund is done automatically based on the age profile of the Subscriber. This is available with three modes:

- Aggressive (LC75)

- Moderate (LC50)

- Conservative (LC25)

Type Of Modes In Auto Life Cycle Fund

- Aggressive LC 75- It is the Life cycle fund where the Cap to Equity investments is 75% of the total asset.

- Moderate LC 50- It is the Life cycle fund where the Cap to Equity investments is 50% of the total asset.

- Conservative LC 25- It is the Life cycle fund where the Cap to Equity investments is 25% of the total asset.

Active Choice

Under this option, Subscribers are free to allocate the investment across the asset class provided i.e. E/C/G/A. Subscriber decides allocation pattern amongst E, C, G and A as mentioned below

Investment Limit in Active management

| ASSET CLASS | CAP ON INVESTMENT |

|---|---|

| Equity (E) | 75% |

| Corporate Bonds (C) | 100% |

| Government Securities (G) | 100% |

| Alternate Investment Funds (A) | 5% |

NPS

TAX BENEFIT

- Subscriber’s contribution is eligible for tax deduction under Sec 80C within the overall ceiling of Rs. 1.50 lakhs.

ADDED TAX REBATE

- You can avail additional tax benefit upto Rs 50,000 under Sec 80 CCD (1B) for investments made under NPS, over and above Rs. 1.50 Lacs invested under sec 80 C

EEE BENEFIT

- NPS is now an EEE product where the Subscriber enjoys tax benefit for his contributions made, the return compounded over the years are tax free and finally when the Subscriber exit the lump sum amount is tax free.

ONLINE ACCESS 24X7

- Riding on a highly efficient technological platform NPS provides online access of accounts to the Subscriber.

VOLUNTARY

Contribute at any point of time in a Financial Year

SIMPLICITY

Subscriber can open an account with any one of the POPs (Point of Presence).

FLEXIBILITY

Choose your own investment option and pension fund and watch your money grow.

PORTABILITY

Operate your account from anywhere, even after changing the city and/or employment.

SAFETY

Regulated by PFRDA, with transparent investment norms, regular monitoring and performance review of fund managers by NPS Trust.

PREMATURE WITHDRAWAL

Subscriber can partially withdraw from NPS tier I account before the age of 60 for specified purposes. Full amount under Tier II can be withdrawn anytime.

PROTEAN (NSDL)

K-FINTECH

NPS

PARTIAL WITHDRAWAL

Subscriber should be in NPS for at-least 3 years.

Amount should not exceed 25% of the contributions made by the Subscribe.

Partial Withdrawal Facility is available for the following specified purpose only:-

- Higher education of children .

- Marriage of children.

- Purchase or construction of residential house or flat.

- Treatment of specified illness (Covid19 included).

- Skill Development/re-skilling or any other self–development activities.

- Establishment of own venture or any start-ups.

Other reasons as specified from time to time by PFRDA.

Frequency of Partial withdrawal: Maximum 3 times during the entire tenure.

CLOSURE PROCESS

The Withdrawal treatment varies based on the age of the subscriber at the time of registration.

REGISTRATION BEFORE 60 YEARS AGE

For Subscriber aged Less Than 60 Years of Age:

- If Corpus less than Rs 2.50 Lakhs, complete withdrawal permitted.

- If the Corpus is more than Rs 2.5 Lacs then the Subscriber has to compulsorily annuitize 80% of the accumulated pension wealth and the remaining 20% can be withdrawn as lump sum.

- In case of death of the Subscriber - Entire accumulated pension fund will be paid to the nominee/s or legal heirs, as per norms. However, Nominee/s can opt for annuity if they desire so.

Under Superannuation or 60 Years:

- If Corpus less than Rs 5.00 Lakhs, complete withdrawal is permitted.

- After attaining 60 years of age, upto 60% of the corpus can be withdrawn. Subscriber is mandatorily required to invest minimum 40% of the accumulated NPS corpus (Pension Wealth) for annuity (To know more about the different annuity plans in NPS visit Click Here). For the 60% amount received at the time of maturity is tax exempted. Thus making NPS an EEE product.

REGISTRATION AFTER 60 YEARS AGE

- At the time of withdrawal, if the Subscriber exits before completing 3 years of holding NPS account, if the corpus is equal to or below 2.5 Lakhs, lump sum is payable. For corpus above 2.5 Lakhs, then 20% lump sum & 80% has to be allocated for annuity option.

- At the time of withdrawal, if the Subscriber exits after completing 3 years of holding NPS account, if the corpus is equal to or below 5 Lakhs, lump sum is payable. For corpus above 5 Lakhs 60-40 option is available , upto 60% of the corpus can be withdrawn. Subscriber is mandatorily required to invest minimum 40% of the accumulated NPS corpus (Pension Wealth) for annuity (40% annuity is minimum condition, if the Subscriber wants more pension he can allocate higher annuity percentage).

Other Important notes

- Subscriber can defer the withdrawal of eligible lump sum amount till the age of 75 years and withdraw the same in 10 annual instalments.

- Annuity purchase can also be deferred for maximum period of 3 years at the time of exit.

NPS

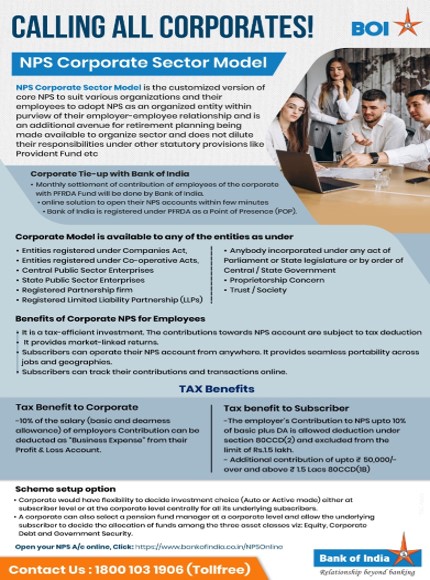

Who can join Corporate NPS?

- All Indian citizens can subscribe to NPS under the corporate model.

- The subscriber should be between 18 to 70 years on the date of opening the NPS account.

- Employees of those organization registered under Corporate model with BOI are eligible to join NPS.

How to register for Corporate NPS?

- Corporates need to register themselves for Corporate NPS through Bank of India. After registration, All corporate sector employees working in an organization that is registered under the corporate NPS model can register for corporate NPS.

- The HR department of the organization needs to authorize the employment details of the subscriber. The subscribers need to comply with the KYC requirements.

10% of the salary (basic and dearness allowance) of employers Contribution can be deducted as “Business Expense” from their Profit & Loss Account.

The contribution in NPS by the employer in employee account upto 10% of Basic + DA is exempted from tax U/S 80CCD(2) upto Rs 7.5 Lacs.

Charges applicable for Subscribers

| Intermediary | Service | Charges | Method of Deduction | |

|---|---|---|---|---|

| POP/Bank | Initial Subscriber Registration | 200 | To be collected upfront through system | |

| UOS (unorganized sector) | Initial Contribution | 0.50% of the contribution, subject to Min. Rs. 30/- and Max.Rs. 25,000/- | ||

| All Subsequent Contribution | ||||

| GST 18% capped on combined account opening charges & contribution charges | ||||

| Corporate Subscribers | Initial Contribution | 0.50% of the contribution, subject to Min. Rs. 30/- and Rs. 25,000/-. | To be collected upfront | |

| All Subsequent Contribution | ||||

| Persistency* | Rs. 50/- p.a. for annual contribution Rs. 1000/- to Rs. 2999/- Rs. 75/- p.a. for annual contribution Rs. 3000/- to Rs. 6000/- Rs. 100/- p.a. for annual contribution above Rs. 6000/ (only for NPS all Citizen) | Through cancellation of units | ||

| Processing of Exit/ Withdrawal | @0.125% of Corpus with Min Rs. 125/- and Max. Rs. 500/- | To be collected upfront | ||

NPS

- POP Registration No. issued by PFRDA -110102018

- Officer's Name - Rahul

- Contact Number - 011-24621814