Visa Signature Debit card

- For Domestic and international Usage. *(International Ecom transactions not allowed)

- No PIN is required up to Rs.5,000/- per contactless transaction.

- PIN is mandatory for all the transactions above the value of Rs.5,000/- per transaction. *(limits are subjected to change in future by RBI)

- Number of contactless transactions allowed per day – Three Transactions.

- Card holders will get rewarded with Star Points for their transactions at POS & ecommerce.

- Card holders can control card activities through BOI Mobile banking App. For more details, please visit https://bankofindia.co.in/

Visa Signature Debit card

Customers having Average Quarterly Balance of Rs. 10 lakhs and above in their savings or current accounts.

Visa Signature Debit card

- ATM - Rs. 1,00,000 domestically or equivalent of Rs 1,00,000 abroad.

- POS and Ecom- Rs. 5,00,000 (Domestic/International or domestically or equivalent of Rs 5,00,000 abroad)

Visa Signature Debit card

- For Charges, please click here

Annexure_VII_Digital_Banking_service_charges.pdf

File-size: 235 KB

Visa Signature Debit card

*only applicable for Debit Cards issued from 01st September 2024 to 28th February 2025. The membership ID will be sent to the eligible users in their registered mobile number via SMS/Whatsapp.

- Membership ID will be sent to the eligible users in their registered mobile number via SMS/Whatsapp.

- Cardholder lands on portal via link - https://visabenefits.thriwe.com/

- Registers (creates account) using membership id, mobile number and OTP, email address and verification

- Cardholder does an INR 1 auth txn to validate identity

- Post registration, every subsequent login will be based on mobile number and OTP

- Post login, cardholder lands on a dashboard which shows available benefits

- Cardholder clicks on any benefit to issue voucher/ code

- Voucher/ code will also be triggered to cardholder via email/ SMS

- Cardholder can login and redeem any benefit depending on validity

- After redemption, the counter for that particular benefit reduces by 1

- Cardholder can access redeemed benefit details anytime post claiming the same

- Membership ids will expire within 90 days of receiving from Visa

- Once membership id is activated/ registered, account is valid for 12 months

- Cardholder to login and click on issue voucher

- A voucher with name of user and expiry date to be issued real-time on the portal

- Cardholder can showcase voucher on lounge to redeem the same

- List of eligible lounges will be available on the portal and hosted on Visa page as well

- Voucher Validity: 12 months from date of issuance

- Escalations to be routed on toll free number or email address mentioned on the portal

- Cardholder to login and click on issue voucher

- A voucher with name of user and expiry date to be issued real-time on the portal

- Cardholder can showcase voucher on lounge to redeem the same

- List of eligible lounges will be available on the portal and hosted on Visa page as well

- Voucher Validity: fixed as per decided by Visa

- Escalations to be routed on toll free number or email address mentioned on the portal

- Cardholder to login and click on issue code

- The generated code to be used on Swiggy/ Amazon to be added to respective wallets and get the bill amount adjusted with the coupon amount

- Voucher Validity: 12 months (Amazon), 3 months (Swiggy)

- Escalations to be routed on toll free number or email address mentioned on the portal

- Cardholder to login and click on issue code

- The generated code to be used on Times Prime App/ webpage to avail subscription

- Voucher Validity: 12 months

- Subscription available for 12 months

- Escalations to be routed on toll free number or email address mentioned on the portal

PRODUCTS YOU MAY LIKE

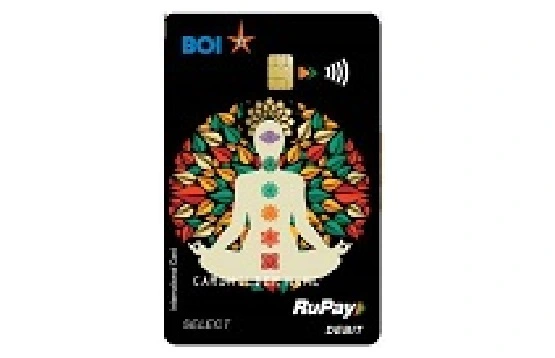

Visa-Signature-Debit-card