Star Laghu Udyami Samekit Loan

Micro & Small Enterprises in rural, semi urban, urban and metro branches

Investment and working capital requirements. This product will be offered to those Micro & Small Enterprises who require both working capital and term/demand loan

Composite Loan in the Form of Demand/Term Loan

| For units located in | Maximum amount of loan |

|---|---|

| Rural Areas | Rs. 5,00,000/- |

| Semi-urban Areas | Rs 10,00,000/- |

| Urban Areas | Rs. 50,00,000/- |

| Metro Areas | Rs. 100,00,000/- |

15%

As applicable

Hypothecation of Assets crated out of bank finance as well as existing unencumbered assets of the MSE unit.

- Equitable Mortgage of Land/Land & Building which is part of the business activity such as business premises

- Guarantee Cover under CGTMSE Guarantee Scheme. No collateral security/third party guarantee to be obtained

Loan is to be repaid in maximum 5 years with a moratorium of 3 to 6 months to be determined on the merits of the case

As applicable

PRODUCTS YOU MAY LIKE

Star MSME Education Plus

Construction, repair and renovation of building, purchase of Furniture & Fixtures and Computers.

Learn More

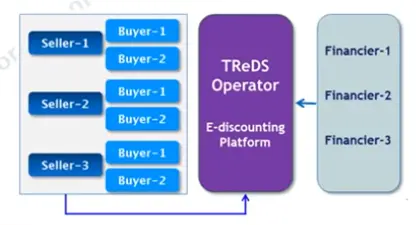

TReDs(Trade Receivables E-Discounting System)

TReDs(Trade Receivables E-Discounting System)

Learn More