Star Msme Gst Plus

To meet the need based Working Capital requirement for trading/services/manufacturing business

Target Group

- All units engaged in trading/manufacturing activity classified under MSME (as per regulatory definition), will be eligible under the scheme

- Units should have valid GSTIN

- The rating of the account should be of minimum investment grade and complying entry level norms

Nature of Facility

Working Capital Limit (Fund Based/Non Fund Based)

Quantum of loan

- Minimum Rs 10.00 lakhs

- Maximum Rs. 500.00 lakhs

- In case of Finance against both Stocks & Book Debts, Drawing Power allowed against Book Debts should not be more than 40% of the total limit

- In case of Finance against only Book Debts, the maximum quantum of loan be restricted to Rs 200.00 lakhs

Security

Primary

- Hypothecation of Stocks

- Hypothecation of Book Debts ( upto 90 days)

Collateral

- Minimum CCR of 65% (wherein CGTMSE is not applicable)

- CGTMSE Coverage (where ever applicable)

Star Msme Gst Plus

*Terms & Conditions apply. For further details, Please contact your Nearest Branch

Star Msme Gst Plus

As Applicable

Margin

25% on Stocks & 40% on Book Debts

Assessment of loan

- Assessment is done strictly as per turnover specified in GSTR – 1 and/or GSTR - 4 returns filed by the borrower and/or GSTR - 4 returns filed by the borrower

- Minimum GSTR – 1 return for minimum three consecutive months is required

- GSTR – 4 return for the preceding quarter is required

- Based on the turnover as per GSTR – 1 ( average of three months)/GSTR – 4, annual projected turnover may be assessed upon

- The quantum of working capital limit should not exceed 25% of annual turnover assessed (in case of Micro & Small enterprises) and 20% (in case of medium enterprises)

Processing & other charges

As Applicable

Star Msme Gst Plus

*Terms & Conditions apply. For further details, Please contact your Nearest Branch

PRODUCTS YOU MAY LIKE

Star MSME Education Plus

Construction, repair and renovation of building, purchase of Furniture & Fixtures and Computers.

Learn More

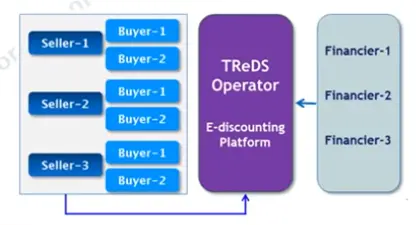

TReDs(Trade Receivables E-Discounting System)

TReDs(Trade Receivables E-Discounting System)

Learn More