Star Sme Liquid Plus

General purpose term loan for SME constituents Viz., for R & D activity, marketing and advertisement expenses Purchase of machineries / equipments, Preliminary expenses etc.

Target group

Proprietorship / Partnership firms, Limited Companies falling within the new definition of SME, engaged in the business for the past 3 years with audited financial statement of accounts

Nature of facility

- Term Loan.

- The safety of this advance will substantially depend on cash flow arising out of activity being financed. It should be ensured that the profits generated / anticipated to be generated turns into liquid cash to service the loan.

Security

- Primary: Hypothecation of assets or mortgage of land , if loan is considered for that purpose. If no assets are created then it should be treated as clean

- Collateral: EQM or Registered Mortgage of Residential / commercial property (1st charge) either of borrower or of guarantor. However following conditions with regard to property under offer should be fulfilled:

- It should not be an agricultural property

- It should not be a vacant land

Insurance

Assets charged to the Bank to be comprehensively insured covering various risks including civil commotions and riots. The policies should be renewed from time to time and copy retained on branch record. Bank’s interest to be got noted in the insurance policy. Separate insurance policy to be obtained for the mortgaged property.

Star Sme Liquid Plus

*Terms & Conditions apply. For further details, Please contact your Nearest Branch

Star Sme Liquid Plus

- The borrower should have known source of funds to pay for the margin and initial recurring expenses.

- Should be profit making for the last 2 years

- Entry level credit rating SBS

- No deviation to be permitted.

Star Sme Liquid Plus

*Terms & Conditions apply. For further details, Please contact your Nearest Branch

Star Sme Liquid Plus

As per prevailing rate of interest structure in terms of HOBC: 113/167 dtd. 13-12-2019.

Appraisal of loan

50% of unencumbered value of the property under offer or 75% of actual requirement for the stated purpose which ever is less

- Minimum : Rs.10 lacs

- Maximum : Rs.500 lacs

Note : Extant guidelines with regard to valuation of property, title clearance and inspection by two different officials etc., must be strictly adhered to.

- Average DSCR should be minimum 1.25.

Repayment

To be repaid in 84 installments within a period of 7 years inclusive of moratorium period of up to 12 months. Interest to be serviced as and when debited.

Processing Fee, Documentation charges etc

As per extent guidelines of the Bank

Star Sme Liquid Plus

*Terms & Conditions apply. For further details, Please contact your Nearest Branch

Star Sme Liquid Plus

Downloadable documents for SLP application to be submitted by the applican

Star Sme Liquid Plus

*Terms & Conditions apply. For further details, Please contact your Nearest Branch

Star Sme Liquid Plus

*Terms & Conditions apply. For further details, Please contact your Nearest Branch

PRODUCTS YOU MAY LIKE

Star MSME Education Plus

Construction, repair and renovation of building, purchase of Furniture & Fixtures and Computers.

Learn More

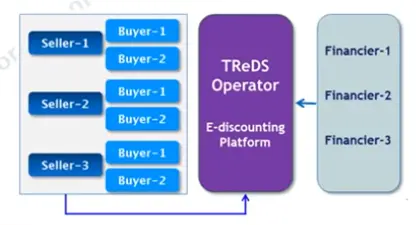

TReDs(Trade Receivables E-Discounting System)

TReDs(Trade Receivables E-Discounting System)

Learn More