ബി ഒ ഐ മൊബൈൽ ഒ എം എൻ ഐ നിയോ ബാങ്ക് ആപ്പ്

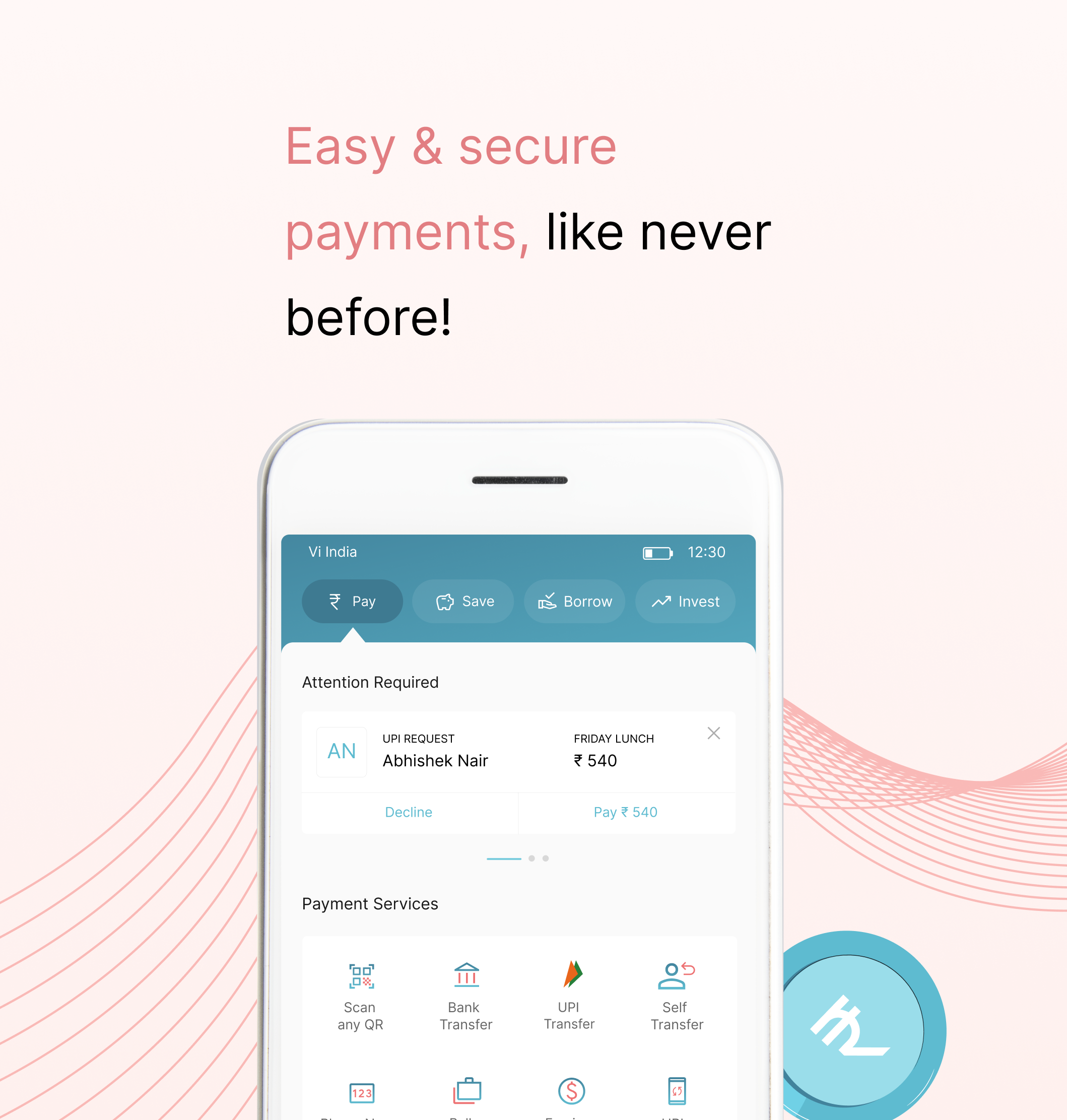

പി എ വൈ

- ഐ എം പി എസ് / എൻ ഇ എഫ് ടി / ആർ ടി ജി എസ് ഉപയോഗിച്ചുള്ള 24x7 ഫണ്ട് ട്രാൻസ്ഫർ സേവനം

- ഗുണഭോക്താവിനെ ചേർക്കാതെ 25,000 രൂപ വരെ ദ്രുത കൈമാറ്റം

- ഗുണഭോക്താക്കളെ മാനേജുചെയ്യുന്നതിന് ഒരു കാഴ്ച, ഓരോ പേയ്മെന്റ് ചാനലിനും ഗുണഭോക്താവിനെ പ്രത്യേകം ചേർക്കേണ്ട ആവശ്യമില്ല

- ബാങ്ക് ഓഫ് ഇന്ത്യയ്ക്കകത്തും പുറത്തുമുള്ള ഫണ്ട് കൈമാറ്റത്തിനായി സ്റ്റാൻഡിംഗ് നിർദ്ദേശങ്ങൾ (എസ്ഐ) സജ്ജമാക്കുക

- ഇപ്പോൾ, ബ്ലോക്ക് ഫണ്ടുകളും ഷെഡ്യൂൾ പേയ് മെന്റ് സൗകര്യവും ഉപയോഗിച്ച് എസ്ഐ സജ്ജമാക്കുക

- നിങ്ങളുടെ ബാങ്ക് അക്കൗണ്ടുകളിലെ എൻ എ സി എച്ച് ഉത്തരവുകളും ഇ-മാൻഡേറ്റുകളും കാണുകയും മാനേജുചെയ്യുകയും ചെയ്യുക, ഓൺലൈനിൽ റദ്ദാക്കൽ അഭ്യർത്ഥിക്കുക, പേയ് മെന്റ് ചരിത്രം കാണുക

- നിങ്ങളുടെ ഡെബിറ്റ് അല്ലെങ്കിൽ ക്രെഡിറ്റ് കാർഡിലെ ആവർത്തന ഉത്തരവുകൾ കാണുകയും മാനേജുചെയ്യുകയും ചെയ്യുക

- 20 വിഭാഗങ്ങളിലായി നിശ്ചിത തീയതി ഓർമ്മപ്പെടുത്തലോടുകൂടിയ ബിൽ പേയ്മെന്റ്

സേവ് ചെയ്യുക

- ഐ എം പി എസ് / എൻ ഇ എഫ് ടി / ആർ ടി ജി എസ് ഉപയോഗിച്ചുള്ള 24x7 ഫണ്ട് ട്രാൻസ്ഫർ സേവനം

- ഗുണഭോക്താവിനെ ചേർക്കാതെ 25,000 രൂപ വരെ ദ്രുത കൈമാറ്റം

- ഗുണഭോക്താക്കളെ മാനേജുചെയ്യുന്നതിന് ഒരു കാഴ്ച, ഓരോ പേയ്മെന്റ് ചാനലിനും ഗുണഭോക്താവിനെ പ്രത്യേകം ചേർക്കേണ്ട ആവശ്യമില്ല

- ബാങ്ക് ഓഫ് ഇന്ത്യയ്ക്കകത്തും പുറത്തുമുള്ള ഫണ്ട് കൈമാറ്റത്തിനായി സ്റ്റാൻഡിംഗ് നിർദ്ദേശങ്ങൾ (എസ്ഐ) സജ്ജമാക്കുക

- ഇപ്പോൾ, ബ്ലോക്ക് ഫണ്ടുകളും ഷെഡ്യൂൾ പേയ് മെന്റ് സൗകര്യവും ഉപയോഗിച്ച് എസ്ഐ സജ്ജമാക്കുക

- നിങ്ങളുടെ ബാങ്ക് അക്കൗണ്ടുകളിലെ എൻ എ സി എച്ച് ഉത്തരവുകളും ഇ-മാൻഡേറ്റുകളും കാണുകയും മാനേജുചെയ്യുകയും ചെയ്യുക, ഓൺലൈനിൽ റദ്ദാക്കൽ അഭ്യർത്ഥിക്കുക, പേയ് മെന്റ് ചരിത്രം കാണുക

കടമെടുക്കുക

- നിങ്ങളുടെ ഡെബിറ്റ് അല്ലെങ്കിൽ ക്രെഡിറ്റ് കാർഡിലെ ആവർത്തന ഉത്തരവുകൾ കാണുകയും മാനേജുചെയ്യുകയും ചെയ്യുക

- 20 വിഭാഗങ്ങളിലായി നിശ്ചിത തീയതി ഓർമ്മപ്പെടുത്തലോടുകൂടിയ ബിൽ പേയ്മെന്റ്

- ഐ എം പി എസ് / എൻ ഇ എഫ് ടി / ആർ ടി ജി എസ് ഉപയോഗിച്ചുള്ള 24x7 ഫണ്ട് ട്രാൻസ്ഫർ സേവനം

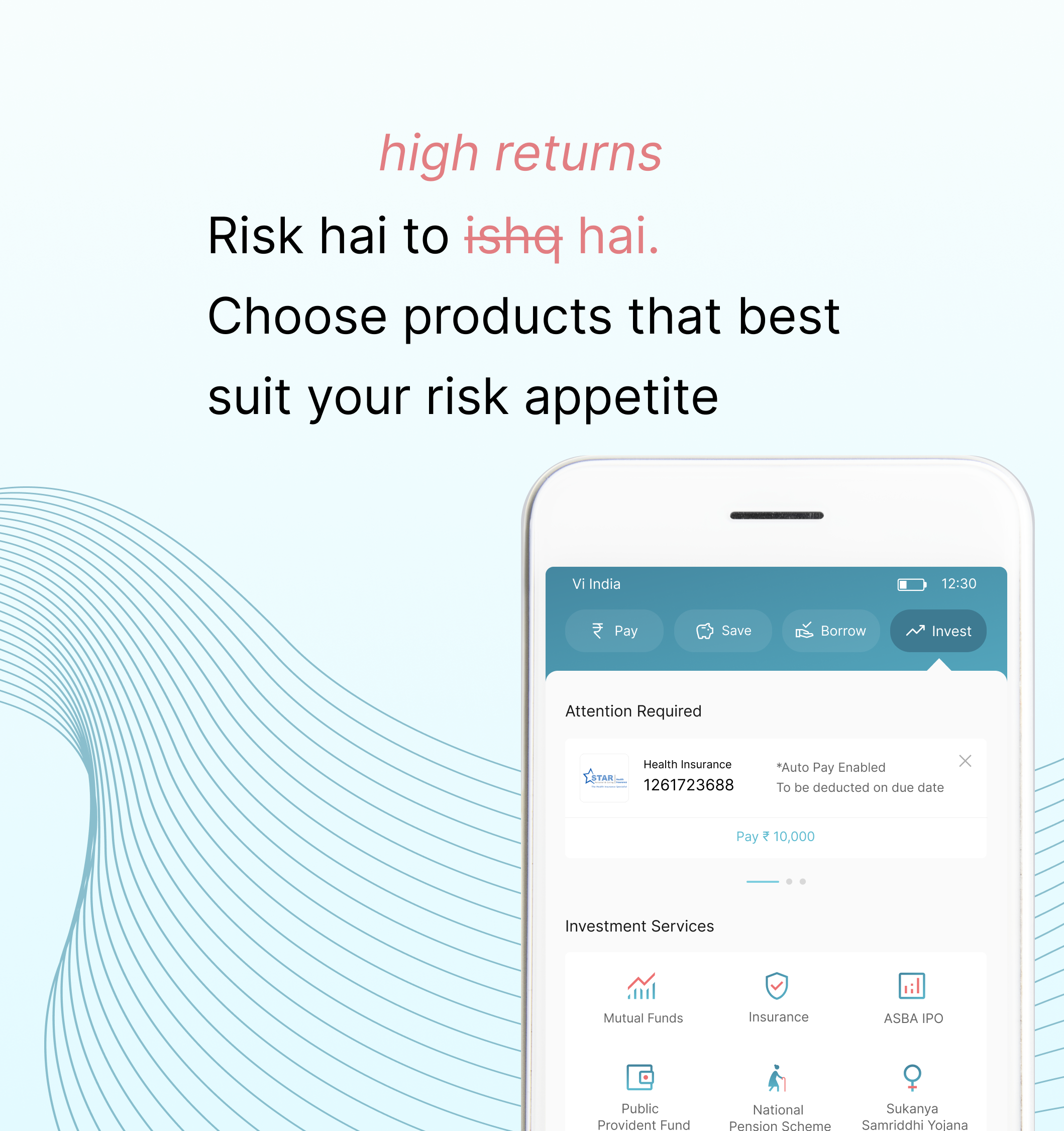

നിക്ഷേപിക്കുക

- ഗുണഭോക്താവിനെ ചേർക്കാതെ 25,000 രൂപ വരെ ദ്രുത കൈമാറ്റം

- ഗുണഭോക്താക്കളെ മാനേജുചെയ്യുന്നതിന് ഒരു കാഴ്ച, ഓരോ പേയ്മെന്റ് ചാനലിനും ഗുണഭോക്താവിനെ പ്രത്യേകം ചേർക്കേണ്ട ആവശ്യമില്ല

- ബാങ്ക് ഓഫ് ഇന്ത്യയ്ക്കകത്തും പുറത്തുമുള്ള ഫണ്ട് കൈമാറ്റത്തിനായി സ്റ്റാൻഡിംഗ് നിർദ്ദേശങ്ങൾ (എസ്ഐ) സജ്ജമാക്കുക

- ഇപ്പോൾ, ബ്ലോക്ക് ഫണ്ടുകളും ഷെഡ്യൂൾ പേയ് മെന്റ് സൗകര്യവും ഉപയോഗിച്ച് എസ്ഐ സജ്ജമാക്കുക

- നിങ്ങളുടെ ബാങ്ക് അക്കൗണ്ടുകളിലെ എൻ എ സി എച്ച് ഉത്തരവുകളും ഇ-മാൻഡേറ്റുകളും കാണുകയും മാനേജുചെയ്യുകയും ചെയ്യുക, ഓൺലൈനിൽ റദ്ദാക്കൽ അഭ്യർത്ഥിക്കുക, പേയ് മെന്റ് ചരിത്രം കാണുക

- നിങ്ങളുടെ ഡെബിറ്റ് അല്ലെങ്കിൽ ക്രെഡിറ്റ് കാർഡിലെ ആവർത്തന ഉത്തരവുകൾ കാണുകയും മാനേജുചെയ്യുകയും ചെയ്യുക

- 20 വിഭാഗങ്ങളിലായി നിശ്ചിത തീയതി ഓർമ്മപ്പെടുത്തലോടുകൂടിയ ബിൽ പേയ്മെന്റ്

ഓഫറിലെ സവിശേഷ സവിശേഷതകൾ

- ഐ എം പി എസ് / എൻ ഇ എഫ് ടി / ആർ ടി ജി എസ് ഉപയോഗിച്ചുള്ള 24x7 ഫണ്ട് ട്രാൻസ്ഫർ സേവനം

- ഗുണഭോക്താവിനെ ചേർക്കാതെ 25,000 രൂപ വരെ ദ്രുത കൈമാറ്റം

- ഗുണഭോക്താക്കളെ മാനേജുചെയ്യുന്നതിന് ഒരു കാഴ്ച, ഓരോ പേയ്മെന്റ് ചാനലിനും ഗുണഭോക്താവിനെ പ്രത്യേകം ചേർക്കേണ്ട ആവശ്യമില്ല

- ബാങ്ക് ഓഫ് ഇന്ത്യയ്ക്കകത്തും പുറത്തുമുള്ള ഫണ്ട് കൈമാറ്റത്തിനായി സ്റ്റാൻഡിംഗ് നിർദ്ദേശങ്ങൾ (എസ്ഐ) സജ്ജമാക്കുക

- ഇപ്പോൾ, ബ്ലോക്ക് ഫണ്ടുകളും ഷെഡ്യൂൾ പേയ് മെന്റ് സൗകര്യവും ഉപയോഗിച്ച് എസ്ഐ സജ്ജമാക്കുക

- നിങ്ങളുടെ ബാങ്ക് അക്കൗണ്ടുകളിലെ എൻ എ സി എച്ച് ഉത്തരവുകളും ഇ-മാൻഡേറ്റുകളും കാണുകയും മാനേജുചെയ്യുകയും ചെയ്യുക, ഓൺലൈനിൽ റദ്ദാക്കൽ അഭ്യർത്ഥിക്കുക, പേയ് മെന്റ് ചരിത്രം കാണുക

- നിങ്ങളുടെ ഡെബിറ്റ് അല്ലെങ്കിൽ ക്രെഡിറ്റ് കാർഡിലെ ആവർത്തന ഉത്തരവുകൾ കാണുകയും മാനേജുചെയ്യുകയും ചെയ്യുക

- 20 വിഭാഗങ്ങളിലായി നിശ്ചിത തീയതി ഓർമ്മപ്പെടുത്തലോടുകൂടിയ ബിൽ പേയ്മെന്റ്

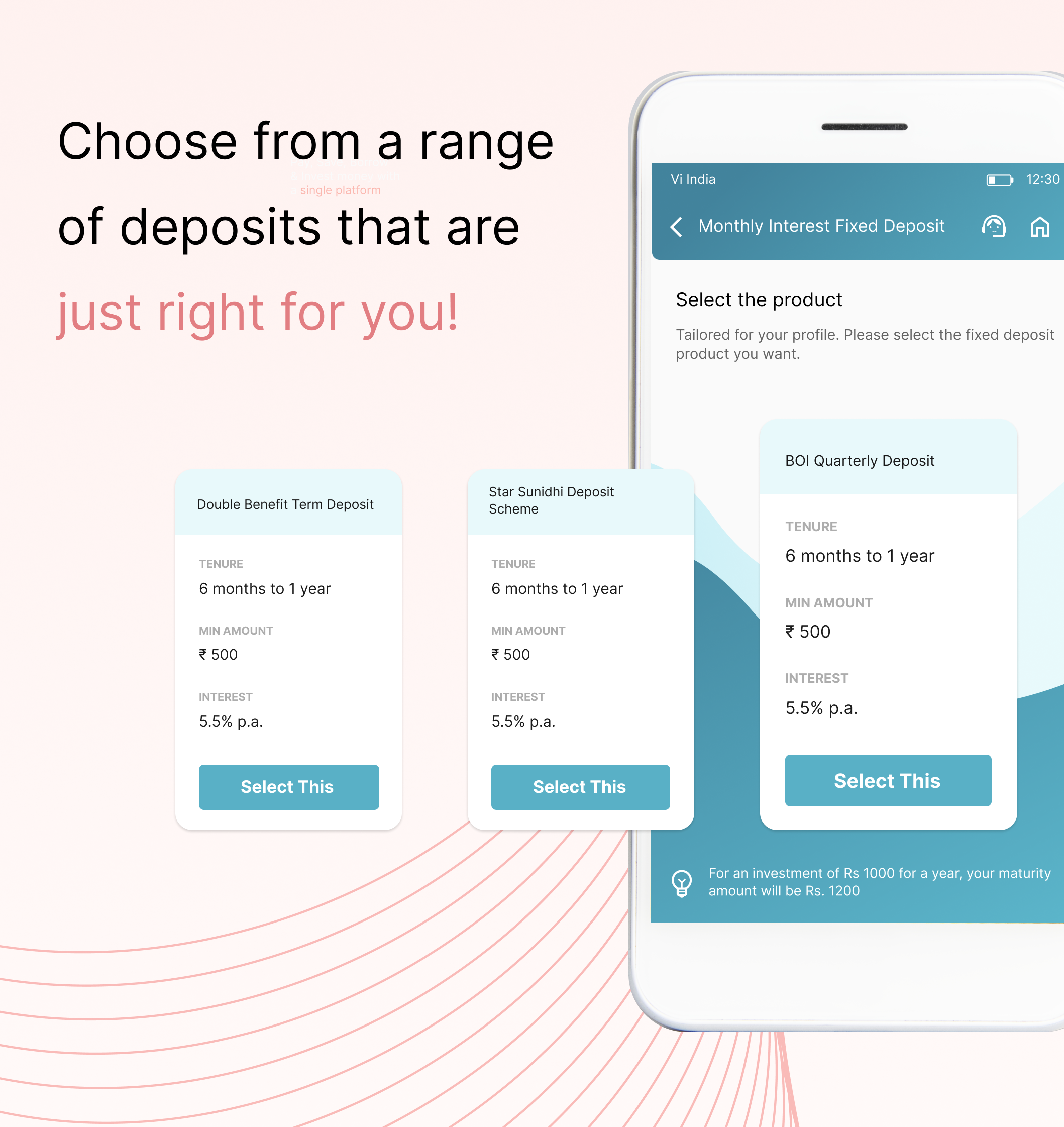

- 2 കോടി രൂപ വരെ സ്ഥിര നിക്ഷേപവും റിക്കറിംഗ് ഡിപ്പോസിറ്റും സൃഷ്ടിക്കുക

- ഓപ്പൺ സ്റ്റാർ സുനിധി (ടാക്സ് സേവർ എഫ്ഡി) ഓൺലൈനിൽ

- നോമിനി ചേർക്കൽ / പരിഷ്കരിക്കൽ എന്നിവ ഉപയോഗിച്ച് നിക്ഷേപങ്ങൾ മാനേജുചെയ്യുക, രസീതുകൾ കാണുക, ടിഡിഎസും പലിശ സർട്ടിഫിക്കറ്റും നേടുക

ബി ഒ ഐ മൊബൈൽ ഒ എം എൻ ഐ നിയോ ബാങ്ക് ആപ്പ്

- ശാഖയുടെ പേര്, എടിഎം ഐഡി, ബിസി പേര്, സ്ഥലം എന്നിവയിൽ തിരയുക

- സംസ്ഥാനം/യു ടി, എൻ ബി ജി, സോൺ എന്നിവയിൽ തിരയുക

- ഡൗൺലോഡ് ഫോർമാറ്റുകളിൽ ലിസ്റ്റ് പങ്കിടാനുള്ള കഴിവ് - പി ഡി എഫ്, എക്സൽ, സി എസ് വി

- മാപ്പ് അടിസ്ഥാനമാക്കിയുള്ള തിരയൽ

- വിവിധ വായ്പകൾക്കും (ക്രെഡിറ്റ് കാർഡിന് മേലുള്ള വായ്പ ഉൾപ്പെടെ) ക്രെഡിറ്റ് കാർഡിനും അപേക്ഷിക്കുക

- ടൈ-അപ്പുകൾ വഴി ഷോപ്പിംഗ് ഓഫറുകൾ ലഭ്യമാണ്

- ബിൽ പേ / റീചാർജ് ലഭ്യമാണ്

- "പരാതികൾ സമർപ്പിക്കാനുള്ള ഓപ്ഷൻ (പൊതുവായതും ഇടപാട് അല്ലാത്തതും)"

- ഇ എം ഐ കാൽക്കുലേറ്റർ

- ബാലൻസ് പരിശോധിക്കുക

- പ്രീലോഗിൻ-ൽ നിന്നുള്ള പിന്തുണ

- എൻ ടി ബി ഉപഭോക്താക്കൾക്ക് വ്യത്യസ്തമായ പ്രീ-ലോഗിൻ സ്ക്രീൻ (ബാങ്കുമായി യാതൊരു ബന്ധവുമില്ലാത്ത രജിസ്റ്റർ ചെയ്ത ഉപഭോക്താക്കൾ)

- ഡെമോ വീഡിയോകൾ

- പതിവുചോദ്യങ്ങൾ ലഭ്യമാണ്

- കുറഞ്ഞ ഉപഭോക്താവിനെ തിരിച്ചുവിളിക്കുന്ന മൂല്യമുള്ള അക്കൗണ്ട് നമ്പർ പോലുള്ള ഫീൽഡുകൾ ആവശ്യപ്പെടരുത്. കസ്റ്റിഡ് ഉപയോഗിച്ച് തടസ്സമില്ലാത്ത രജിസ്ട്രേഷൻ.

- ലോഗിൻ ഐഡി /എം പി ഐ എൻ മറന്നു

- പാസ്വേഡ് മറന്നോ

- രണ്ടാം ഘടകം പ്രാമാണീകരണത്തിന് മുമ്പ് ലോഗിൻ ചെയ്യുമ്പോൾ അക്കൗണ്ട് ബാലൻസ് കാണിക്കുന്നു

- മുഴുവൻ ഉപഭോക്തൃ ബന്ധത്തിനും ഒറ്റ ലോഗിൻ

- നിർദ്ദിഷ്ട സ്ക്രീനിൽ ആരംഭിക്കാനുള്ള ഓപ്ഷൻ

- എല്ലാ സ്ക്രീനിൽ നിന്നും ഹോം സ്ക്രീനിലേക്ക് മടങ്ങാനുള്ള ഓപ്ഷൻ

- ക്രെഡൻഷ്യലുകൾ നമ്പറുകൾ ഉപയോഗിച്ച് സജ്ജീകരിക്കുമ്പോൾ ന്യൂമെറിക് കീപാഡ് തുറക്കുക.

- സമ്പൂർണ്ണ വിജയത്തിനായി ഒരൊറ്റ പിൻ/പാസ്വേഡ് പോസ്റ്റ് ആക്റ്റിവേഷൻ സജ്ജീകരിക്കുന്നതിനുള്ള ഓപ്ഷൻ (എം-പിൻ, ആപ്ലിക്കേഷൻ പാസ്വേഡ് എന്നിവയ്ക്ക് പകരം സിംഗിൾ പിൻ)

- ക്യു ആർ ഉപയോഗിച്ച് ലോഗിൻ ചെയ്യുക

- ആപ്പ് രജിസ്ട്രേഷനിലും തൽക്ഷണ പാസ്വേഡ് ജനറേഷനിലും - മൊബൈൽ ഉപകരണങ്ങളിലൂടെ ആക്സസ് ചെയ്യുക

- ഓൺലൈൻ രജിസ്ട്രേഷൻ - ബ്രൗസറിലൂടെ പ്രവേശനം

- പുതിയ ഉപയോക്താക്കൾക്കും (സൈൻഅപ്പ്) നിലവിലുള്ള ഉപയോക്താക്കൾക്കും (ലോഗിൻ) പ്രത്യേകം ഓപ്ഷൻ വ്യക്തമായി അവതരിപ്പിക്കുക

- ഒന്നിലധികം ഉപകരണങ്ങളിൽ നിന്ന് രജിസ്ട്രേഷനുകൾ/ലോഗിനുകൾ അനുവദനീയമാണ്

- ആദ്യ രജിസ്ട്രേഷനിൽ രണ്ട് ഘട്ട പ്രാമാണീകരണം

- വിജയകരമായ പ്രാമാണീകരണം സംബന്ധിച്ച് രജിസ്റ്റർ ചെയ്ത മൊബൈൽ നമ്പറിലേക്ക് (ആർ എം എൻ) സന്ദേശം അയയ്ക്കുക

- ബയോമെട്രിക്സ് ഉപയോഗിച്ച് ലോഗിൻ ചെയ്യുക, ഉദാ: ടച്ച് ഐഡി, ഫേസ് ഐഡി, വോയ്സ് അടിസ്ഥാനമാക്കി

- രജിസ്റ്റർ ചെയ്യുക / ആദ്യമായി ലോഗിൻ ചെയ്യുക

- ലോഗിൻ ഐഡി / പേര് / എം പി ഐ എൻ സജ്ജീകരിക്കുക

- ബയോമെട്രിക് ഉൾപ്പെടെയുള്ള ലോഗിൻ ക്രെഡൻഷ്യലുകൾ സജ്ജമാക്കുക (ജീവനക്കാർക്കും ബാങ്കിംഗ് കറസ്പോണ്ടൻറുകൾക്കും ബയോമെട്രിക് പ്രാമാണീകരണം നിർബന്ധമാണ് - പരിഷ്ക്കരിക്കാവുന്ന പാരാമീറ്ററുകൾ അനുസരിച്ച് പങ്കാളികൾ, റീട്ടെയിൽ ഉപഭോക്താക്കൾ, കോർപ്പറേറ്റ് ഉപഭോക്താക്കൾ, അവരുടെ ഏജൻ്റുമാർ എന്നിവർക്ക് ഓപ്ഷണൽ.)

- ബയോമെട്രിക് ഉൾപ്പെടെയുള്ള ഇടപാട് സൗകര്യത്തിന് ഉപയോക്തൃ മുൻഗണന

- ഇടപാട് ക്രെഡൻഷ്യലുകൾ സജ്ജമാക്കുക

- ഒറ്റ പിൻ/പാസ്വേർഡിനുള്ള ഓപ്ഷൻ

- യൂസർഐഡി/പാസ്വേഡ്/പിൻ ഉപയോഗിച്ച് ഇൻ്റർനെറ്റ് ബാങ്കിംഗ് ലോഗിൻ ചെയ്യുക

- ഉപയോക്താവിന് ലോഗിൻ ചെയ്യേണ്ട സമയത്ത് മാത്രം ലോഗിൻ ഐഡി/പേര് ആവശ്യമാണ്

- ജീവനക്കാർക്കും ബാങ്കിംഗ് കറസ്പോണ്ടൻറുകൾക്കും ബയോമെട്രിക് പ്രാമാണീകരണം നിർബന്ധമാണ് - പങ്കാളികൾ, റീട്ടെയിൽ ഉപഭോക്താക്കൾ, കോർപ്പറേറ്റ് ഉപഭോക്താക്കൾ, അവരുടെ ഏജൻ്റുമാർ എന്നിവർക്ക് പരിഷ്ക്കരിക്കാവുന്ന പാരാമീറ്ററുകൾ അനുസരിച്ച് ഓപ്ഷണൽ.

- ലോഗിൻ ചെയ്യാനുള്ള പാസ്വേഡ് ലിങ്ക് മറന്നുപോയി

- ലോഗിൻ പാസ്വേഡ് കാലഹരണപ്പെടുമ്പോൾ പാസ്വേഡ് നിർബന്ധിക്കുക

- ലോഗിൻ ക്രെഡൻഷ്യലുകൾ സ്വീകരിക്കുക

- സിംഗിൾ പിൻ/പാസ്വേഡിനുള്ള ഓപ്ഷൻ

- സിമ്മുമായി ബന്ധപ്പെട്ട വ്യതിയാനങ്ങളും പിശകുകളും

- അഡാപ്റ്റീവ് ആധികാരികത

- എൻ ടി ബി രജിസ്ട്രേഷൻ

- എൻ ടി ബി മുതൽ ഇ ടി ബി വരെ പരിവർത്തനം

- ഉൾപ്പെടെയുള്ള വ്യക്തിഗത വിശദാംശങ്ങൾ കാണുക.സി കെ വൈ സി/ പാൻ

- പ്രാഥമിക അക്കൗണ്ടുകൾ സജ്ജമാക്കുക

- എല്ലാ അക്കൗണ്ടുകളും ഉപഭോക്താവുമായി ലിങ്ക് ചെയ്യാൻ പാടില്ല. എല്ലാ അക്കൗണ്ടുകളും പ്രദർശിപ്പിക്കാമെങ്കിലും, ഉപഭോക്താക്കളുടെ തിരഞ്ഞെടുപ്പിന് അനുസരിച്ചായിരിക്കണം ഇത്.

- ഹോം പേജിൽ ഉപഭോക്താവിൻ്റെ പേര് കാണിക്കുന്നു

- ക്യു ആർ വഴി എ/സി വിശദാംശങ്ങൾ പങ്കിടുക

- പ്രൊഫൈൽ വഴി ആപ്പിലെ ഒന്നിലധികം വിഭാഗങ്ങളിലേക്കുള്ള ദ്രുത ലിങ്കുകൾ

- ഉൽപ്പന്ന സവിശേഷതകൾ

- എം-പിൻ/ബയോമെട്രിക്സ് മാറ്റുക

- മൊബൈൽ ബാങ്കിംഗ് പരിധികൾ സജ്ജമാക്കുക

- മൊബൈൽ ബാങ്കിംഗ് പരിധികൾ പരിഷ്ക്കരിക്കുക

- സ്ഥിരസ്ഥിതി എ/സി സജ്ജമാക്കുക

- ഇടപാട് അവകാശങ്ങൾ കൈകാര്യം ചെയ്യുക

- തിരഞ്ഞെടുത്ത എം എഫ് എ സജ്ജമാക്കുക

- തിരഞ്ഞെടുത്ത എം എഫ് എ മാറ്റുക

- ഡിഫോൾട്ട് ആപ്പ് ഭാഷ മാറ്റുക

- സ്ലീപ്പ് മോഡ്

- മൊബൈൽ ബാങ്കിംഗിൽ നിന്നുള്ള രജിസ്ട്രേഷൻ റദ്ദാക്കൽ

- ലോഗിൻ പാസ്വേഡ്

- ഇടപാട് പരിധിക്കുള്ള ഇഷ്ടാനുസൃത ക്രമീകരണം

- ക്രെഡിറ്റ് കാർഡ് പിൻ ഉപയോഗിച്ച് 2എഫ് എ സജ്ജീകരിക്കുന്നു

- ഡെബിറ്റ് കാർഡ് പിൻ ഉപയോഗിച്ച് 2എഫ് എ സജ്ജീകരിക്കുന്നു

- മൊബൈൽ ഒ ടി പി ഉപയോഗിച്ച് 2എഫ് എ സജ്ജീകരിക്കുന്നു

- എം പിൻ ഉപയോഗിച്ച് 2എഫ് എ സജ്ജീകരിക്കുന്നു

- അറിയിപ്പുകളും അലേർട്ട് ക്രമീകരണവും (ഇടപാട് അലേർട്ടുകൾ നിർബന്ധമാണ്)

- ബാങ്ക് ലെവൽ പരിധിക്കുള്ളിൽ പാസ്വേഡ് മാറ്റാനുള്ള ഇടവേള

- ഡീ-രജിസ്റ്റർ ചെയ്യുക

- തടയുന്നു

- അൺബ്ലോക്ക് ചെയ്യുന്നു

- പ്രസ്താവനകൾ (കഴിഞ്ഞ മാസം/3 മാസം/6 മാസം/വർഷം) കലണ്ടർ/സാമ്പത്തിക വർഷം വേഗത്തിൽ ഡൗൺലോഡ് ചെയ്യുന്നതിനുള്ള ലിങ്കുകൾ

- ഇടപാടിൻ്റെ സംഗ്രഹ കാഴ്ച

- യു പി ഐ ഇടപാടുകൾക്കായി അവസാന 5 ഇടപാടുകൾക്കൊപ്പം മിനി സ്റ്റേറ്റ്മെൻ്റ് സൃഷ്ടിക്കുക

- ഹോം പേജിൽ നിന്ന് ഒറ്റ ക്ലിക്കിൽ ഇടപാട് വിശദാംശങ്ങൾ കാണാനുള്ള ഓപ്ഷൻ

- മുൻകൂർ തിരയലിനൊപ്പം അക്കൗണ്ട് സ്റ്റേറ്റ്മെൻ്റ് കാണാനുള്ള ഓപ്ഷൻ

- കാലയളവ് സജ്ജീകരിച്ച് കഴിഞ്ഞ ഇടപാടുകൾ കാണുക

- കഴിഞ്ഞ 1 വർഷം വരെയുള്ള പ്രസ്താവനകൾ/ഇടപാട് ചരിത്രം കാണാനുള്ള കഴിവ്

- വ്യക്തിഗത കസ്റ്റമർ ഓൺബോർഡിംഗ് - പുതിയത്

- വ്യക്തിഗത കസ്റ്റമർ ഓൺബോർഡിംഗ് - നിലവിലുണ്ട്

- നോമിനി രജിസ്ട്രേഷൻ

- സവിശേഷതകൾ തിരഞ്ഞെടുക്കുക

- ഡോക്യുമെൻ്റ് ക്യാപ്ചർ

- അക്കൗണ്ട് തുറക്കൽ യാത്ര

- പാൻ മൂല്യനിർണ്ണയം

- സി കെ വൈ സി ചെക്ക്

- കെ വൈ സി പ്രക്രിയ

- കസ്റ്റമർ ഡ്യൂപ്ലിക്കേഷൻ പരിശോധന

- നെഗറ്റീവ് ലിസ്റ്റും എഎംഎൽ പരിശോധനയും

- ചെക്ക് ബുക്ക് വിതരണം

- വീഡിയോ കെ വൈ സി

- ബ്രാഞ്ച് നിർദ്ദേശത്തിനുള്ള ഗൂഗിൾ എ പി ഐ

- ടി ഡി ആർ അക്കൗണ്ട് സൃഷ്ടിക്കൽ (ആവർത്തിച്ചുള്ള / സ്ഥിരമായത്)

- ഡെപ്പോസിറ്റ് കാൽക്കുലേറ്റർ പ്രദർശിപ്പിക്കുക

- എഫ് ഡി / ആർ ഡി നിർദ്ദേശം മാറ്റുക

- നോമിനി വിശദാംശങ്ങൾ അപ്ഡേറ്റ് ചെയ്യുക

- എഫ് ഡി ഉപദേശം സൃഷ്ടിക്കുക

- എഫ്ഡിക്കെതിരെ ഓവർഡ്രാഫ്റ്റ് നേടുക

- ഉൽപ്പന്ന നിർദ്ദേശങ്ങൾ നിക്ഷേപിക്കുക

- ടി ഡി ആർ മെച്യൂരിറ്റി അന്വേഷണം

- സി എ എസ് എ അക്കൗണ്ട് ലിങ്ക് ചെയ്യുന്നു

- ഫണ്ടിംഗ് / ഓട്ടോ എസ്ഐ ക്രിയേഷൻ

- ബി. അകാല അടച്ചുപൂട്ടൽ

- ആർഡിക്കെതിരെ ഓവർഡ്രാഫ്റ്റ് പ്രയോജനപ്പെടുത്തുക

- മാർജിൻ പാരാമീറ്ററിൽ മൂല്യം പാസാക്കുന്നതിനുള്ള ടി ഡി, ലോജിക്ക് എന്നിവയ്ക്കെതിരെ ഉപയോക്താവ് ഒ ഡി തിരഞ്ഞെടുത്തപ്പോൾ അധിക വിശദാംശങ്ങൾ/ മൂല്യനിർണ്ണയം

- ഉൽപ്പന്ന ലിസ്റ്റ് - യു എ-യിൽ സൂക്ഷിക്കണം (അഡ്മിനിൽ)

- ടിഡിക്കെതിരെ ഒ.ഡി

- സൂപ്പർ സീനിയർ സിറ്റിസൺ ടി.ഡി

- അന്വേഷണം

- പിൻ ജനറേഷൻ/റീസെറ്റ്

- തടയൽ/അൺബ്ലോക്ക് ചെയ്യുന്നു

- നഷ്ടപ്പെട്ട/മോഷ്ടിച്ച കാർഡ്

- ആഭ്യന്തര /അന്താരാഷ്ട്ര /എടിഎം/പിഒഎസ്/എൻഎഫ്സിക്ക് പരിധികൾ സജ്ജമാക്കുക

- ഇൻ്റർനാഷണൽ ട്രാവൽ ചേർക്കുക/ പരിഷ്ക്കരിക്കുക / ഇല്ലാതാക്കുക

- ആവർത്തിച്ചുള്ള ഓട്ടോ ഡെബിറ്റ് മാൻഡേറ്റ് മാനേജ്മെൻ്റ്-എസ്ഐ

- തിരിച്ചടവ്

- വീണ്ടെടുക്കൽ - ഓട്ടോ ഡെബിറ്റ് സജ്ജീകരണം

- ഇ എം ഐ പരിവർത്തനം

- ആഡ് ഓൺ

- സ്റ്റേറ്റ്മെൻ്റ് (ബിൽ ചെയ്ത/ബിൽ ചെയ്യാത്ത/പൊതുവായ - പ്രീപെയ്ഡ് കാർഡുകൾ)

- പേയ്മെൻ്റ് സംഗ്രഹം

- അന്വേഷണം

- പിൻ ജനറേഷൻ/റീസെറ്റ്

- തടയൽ/അൺബ്ലോക്ക് ചെയ്യുന്നു

- നഷ്ടപ്പെട്ട/മോഷ്ടിച്ച കാർഡ്

- ആഭ്യന്തര /അന്താരാഷ്ട്ര /എടിഎം/പിഒഎസ്/എൻഎഫ്സിക്ക് പരിധികൾ സജ്ജമാക്കുക

- ഇൻ്റർനാഷണൽ ട്രാവൽ ചേർക്കുക/ പരിഷ്ക്കരിക്കുക / ഇല്ലാതാക്കുക

- മറ്റ് ബാങ്ക് അക്കൗണ്ട്

- സ്വയം അക്കൗണ്ട് കൈമാറ്റം

- പേയ്മെൻ്റ് ആവർത്തിക്കുക

- ഗുണഭോക്താവിനെ ചേർക്കാതെ വേഗത്തിലുള്ള ശമ്പളം

- ഫണ്ടുകൾ പിൻവലിക്കുക

- ഗുണഭോക്താവിൻ്റെ അക്കൗണ്ട് മൂല്യനിർണ്ണയം

- വിജയ സ്ക്രീനിൽ നിന്ന് ഗുണഭോക്താവിനെ ചേർക്കുക

- ബി ഒ ഐ-നുള്ളിൽ എ/സി നമ്പർ

- ബി ഒ ഐ-ന് പുറത്ത് എ/സി ഇല്ല

- ഫോൺ നമ്പർ

- വി.പി.എ

- ഫോൺ നമ്പർ + എം എം ഐ ഡി

- കാണുക

- ഇല്ലാതാക്കുക

- പരിഷ്ക്കരിക്കുക

- സ്റ്റാൻഡിംഗ് ഇൻസ്ട്രക്ഷൻ സജ്ജമാക്കുക

- സ്റ്റാൻഡിംഗ് ഇൻസ്ട്രക്ഷൻ പരിഷ്ക്കരിക്കുക

- സ്റ്റാൻഡിംഗ് ഇൻസ്ട്രക്ഷൻ ഇല്ലാതാക്കുക

- കാർഡുകളിലെ എസ് ഐ ഇല്ലാതാക്കുക

- എസ് ഐ കാർഡുകളുടെ ഇൻവോയ്സ് നിർത്തുക

- കാർഡുകളിലെ എസ്ഐ പരിഷ്ക്കരിക്കുക

- പിക്കപ്പ് അഭ്യർത്ഥന (കോൾ / ഓൺലൈനിൽ ബുക്ക് ചെയ്യുക)

- ഡ്രോപ്പ് അഭ്യർത്ഥന (കോൾ / ഓൺലൈനിൽ ബുക്ക് ചെയ്യുക)

- ഉപഭോക്തൃ ഫീഡ്ബാക്ക്

- ഉപഭോക്തൃ പരാതികൾ/ഉയർച്ചകൾ

- സേവന അഭ്യർത്ഥന ട്രാക്കിംഗ്

- പരാതി/എസ്കലേഷൻ രജിസ്റ്റർ/ ട്രാക്കിംഗ്

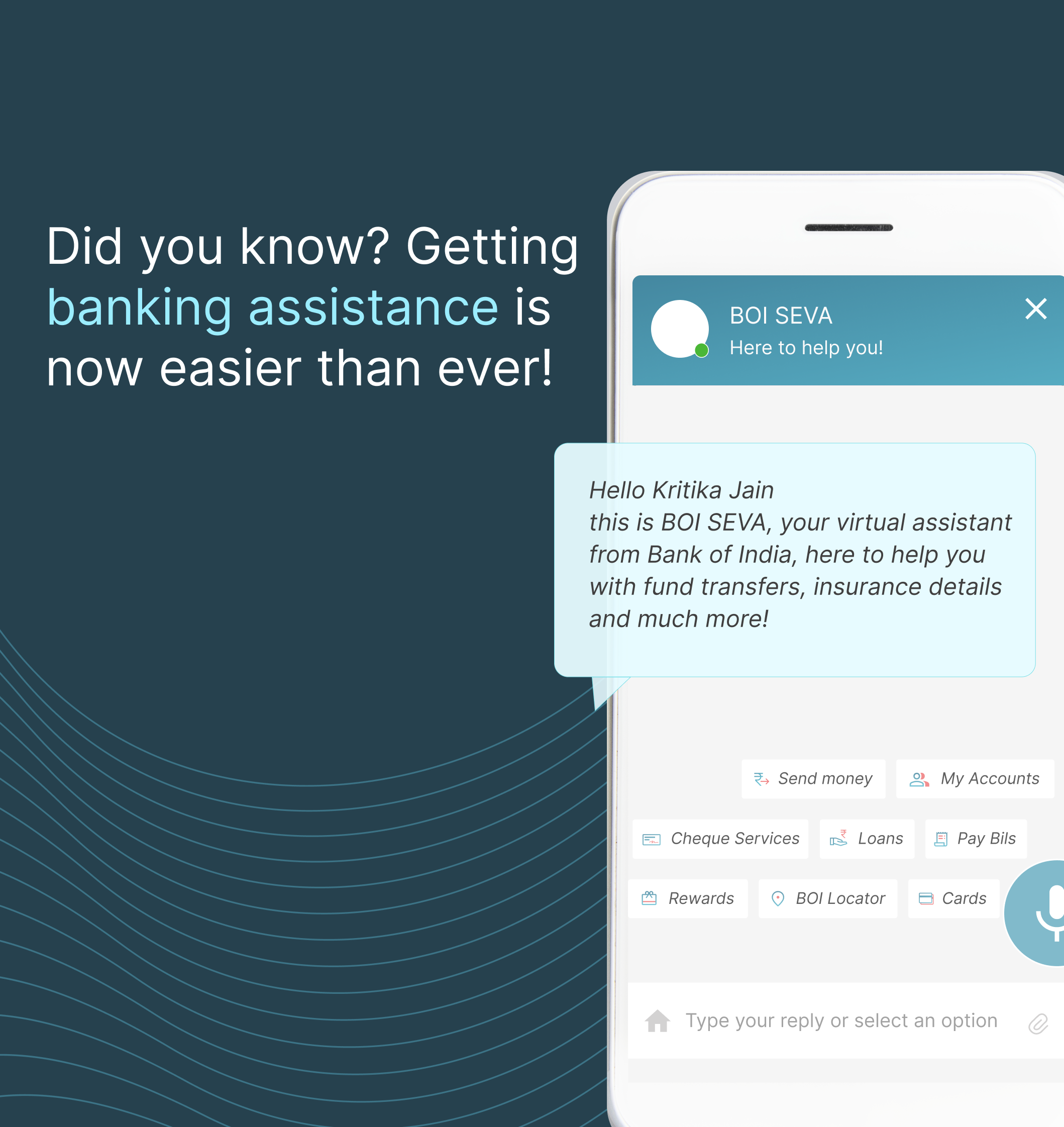

- ആപ്പ് ഫീച്ചറുകളിലും നാവിഗേഷനിലും സ്വയമേവയുള്ള സഹായം, കുറഞ്ഞത് ആദ്യ ലോഗിൻ ചെയ്യുമ്പോഴെങ്കിലും

- ലോഗിൻ പേജിൽ പ്രദർശിപ്പിച്ചിരിക്കുന്ന സുരക്ഷാ/സ്വകാര്യത ഉള്ളടക്കത്തിലേക്കുള്ള മാർഗ്ഗനിർദ്ദേശം/ ലിങ്ക്

- ഞങ്ങളെ സമീപിക്കുക

- ഹോം സ്ക്രീനിൽ തിരയൽ ടൂൾ ബാറിൻ്റെ സാന്നിധ്യം

- ഫോൺ ബാങ്കിംഗ് കോൺടാക്റ്റ് നമ്പർ പ്രദർശിപ്പിക്കുന്നു

- പതിവുചോദ്യങ്ങൾ ലഭ്യമാണ്

- ചാറ്റ്ബോട്ട്

- വിവിധ ഉൽപ്പന്നങ്ങളുടെ / ഫീച്ചറുകളുടെ ഡെമോ

- പരാതി ഉന്നയിക്കുക

- രേഖകൾ നൽകുക

- പരാതി ട്രാക്ക് ചെയ്യുക

- പരാതിയുടെ തൃപ്തി റേറ്റിംഗ്

- പരാതി ചരിത്രം

- പ്രതികരണം അറിയിക്കുക

- ഫീഡ്ബാക്ക് കാണുക

- ഉപയോക്തൃ ഫീഡ്ബാക്ക് ഉചിതമായ രീതിയിൽ പരിഷ്ക്കരിക്കുന്നതിനും/മെച്ചപ്പെടുത്തുന്നതിനും

- എൻ എ സി എച്ച് റദ്ദാക്കൽ

- എൻ എ സി എച്ച് മാൻഡേറ്റ് കാഴ്ച, എൻ എ സി എച്ച്-നുള്ള പേയ്മെൻ്റ് ചരിത്രം

- പിപിഎഫ് സംഭാവന

- എസ് എസ് വൈ സംഭാവന

- എൻ പി എസ് സംഭാവന

- സിംഗിൾ

- ഒന്നിലധികം/വിഭജനം

- യു ഡി ഐ ആർ

- റീചാർജ് ചെയ്യുക

- പുതിയ ബില്ലർ

- നിലവിലുള്ള ബില്ലർ - ബിൽ അടയ്ക്കുക

- നിലവിലുള്ള ബില്ലർ - അപ്ഡേറ്റ്

- നിലവിലുള്ള ബില്ലർ - റദ്ദാക്കുക

- ബില്ലർമാരുടെ ലിസ്റ്റ് ലഭ്യമാക്കുക

- തിരഞ്ഞെടുത്ത ബില്ലറിനായി പാരാമീറ്ററുകൾ ലഭ്യമാക്കുക

- എൻപിസിഐയ്ക്കായുള്ള മാസ്റ്റർ ഡാറ്റ മാനേജ്മെൻ്റ് ബില്ലേഴ്സ് ലിസ്റ്റ് പ്രസിദ്ധീകരിച്ചു.

- രസീത് ഡൗൺലോഡ് ചെയ്യുക

- പേയ്മെൻ്റ് റിവേഴ്സൽ

- ബിൽ അവതരണം രജിസ്ട്രേഷൻ

- ഡി ഇ-രജിസ്ട്രേഷൻ ബിൽ അവതരണം

- വിശദമായ അന്വേഷണം

- ബില്ലർ ലഭ്യത നില പരിശോധിക്കുക

- പുതിയ എം എഫ് വാങ്ങുക

- കെ വൈ സി മൂല്യനിർണ്ണയം

- കെ വൈ സി ക്യാപ്ചറും സമർപ്പിക്കലും

- എഫ് എ ടി സി എ - മൂല്യനിർണ്ണയം

- ടി & സി യിലേക്കുള്ള സ്വീകാര്യത

- നിക്ഷേപ അക്കൗണ്ട് സൃഷ്ടിക്കൽ

- എം എഫ് പ്ലാനിൻ്റെ വാങ്ങൽ (ലമ്പ് സം, എസ് ഐ പി)

- പുതിയത് വാങ്ങുക

- കെ വൈ സി മൂല്യനിർണ്ണയം

- കെ വൈ സി ക്യാപ്ചറും സമർപ്പിക്കലും

- ടി & സി യിലേക്കുള്ള സ്വീകാര്യത

- സൃഷ്ടിക്കാൻ അഭ്യർത്ഥിക്കുക

- സർട്ടിഫിക്കറ്റുകൾ ഡൗൺലോഡ് ചെയ്യുക

- ഇടപാടിൻ്റെ നില കാണുക

- പുതിയത് വാങ്ങുക

- കെ വൈ സി മൂല്യനിർണ്ണയം

- കെ വൈ സി ക്യാപ്ചറും സമർപ്പിക്കലും

- ടി & സി യിലേക്കുള്ള സ്വീകാര്യത

- സൃഷ്ടിക്കാൻ അഭ്യർത്ഥിക്കുക

- സർട്ടിഫിക്കറ്റുകൾ ഡൗൺലോഡ് ചെയ്യുക

- ഇടപാടിൻ്റെ നില കാണുക

- എ എസ് ബി എ പരിഷ്ക്കരിക്കുക

- എ എസ് ബി എ ഇല്ലാതാക്കുക

- ഓർഡർ നില

- ആപ്ലിക്കേഷൻ ഐഡി സൃഷ്ടിക്കൽ

- ഓർഡർ പരിഷ്ക്കരിക്കുക / പിൻവലിക്കുക

- ഇൻഷുറൻസ് റിലയൻസ് മോട്ടോർ 4W- പുതിയ ബിസിനസ്സ് (സമഗ്ര + ടിപി) പുതിയ പോളിസി വാങ്ങുക

- ഇൻഷുറൻസ് റിലയൻസ് മോട്ടോർ 2W- പുതിയ ബിസിനസ്സ് (സമഗ്ര + ടി പി) പുതിയ പോളിസി വാങ്ങുക

- ഇൻഷുറൻസ് റിലയൻസ് പ്രീമിയം അടയ്ക്കുക

- ഇൻഷുറൻസ് റിലയൻസ് പോർട്ട്ഫോളിയോ

- ഇൻഷുറൻസ് റിലയൻസ് പോളിസി ഡൗൺലോഡ് ചെയ്യുക

- ഇൻഷുറൻസ് റിലയൻസ് ഉദ്ധരണി ജനറേഷൻ

- യോഗ്യതാ പരിശോധന

- ചോദ്യാവലി പിടിച്ചെടുക്കൽ

- നാമനിർദ്ദേശം

- സി കെ വൈ സി ചെക്ക്

- ഇൻഷുറൻസ് റിലയൻസ് ഹെൽത്ത് ഗെയിൻ പോളിസി വാങ്ങൽ പുതിയ പോളിസി വാങ്ങുക

- ഇൻഷുറൻസ് റിലയൻസ് പ്രീമിയം അടയ്ക്കുക

- ഇൻഷുറൻസ് റിലയൻസ് പോർട്ട്ഫോളിയോ

- ഇൻഷുറൻസ് റിലയൻസ് പോളിസി ഡൗൺലോഡ് ചെയ്യുക

- ഇൻഷുറൻസ് റിലയൻസ് ഉദ്ധരണി ജനറേഷൻ

- യോഗ്യതാ പരിശോധന

- ചോദ്യാവലി പിടിച്ചെടുക്കൽ

- നാമനിർദ്ദേശം

- സി കെ വൈ സി ചെക്ക്

- ഇൻഷുറൻസ് സുഡ്ലൈഫ് സുഡ്ലൈഫ് പി ഒ എസ് സഞ്ചയ് പുതിയ പോളിസി വാങ്ങുന്നു

- ഇൻഷുറൻസ് സുഡ്ലൈഫ് സെഞ്ച്വറി റോയൽ പുതിയ പോളിസി വാങ്ങുന്നു

- ഇൻഷുറൻസ് സുഡ്ലൈഫ് ഗ്രൂപ്പ് ടേം ഇൻഷുറൻസ് പുതിയ പോളിസി വാങ്ങുന്നു

- ഇൻഷുറൻസ് സുഡ്ലൈഫ് പ്രീമിയം അടയ്ക്കുക

- ഇൻഷുറൻസ് സുഡ്ലൈഫ് പോർട്ട്ഫോളിയോ

- ഇൻഷുറൻസ് സുഡ്ലൈഫ് പോളിസി ഡൗൺലോഡ് ചെയ്യുക

- ഇൻഷുറൻസ് സുഡ്ലൈഫ് സുഡ്ലൈഫ്ഉദ്ധരണി ജനറേഷൻ

- യോഗ്യതാ പരിശോധന

- ചോദ്യാവലി പിടിച്ചെടുക്കൽ

- നാമനിർദ്ദേശം

- സി കെ വൈ സി ചെക്ക്

- ഇടപാടിൻ്റെ നില കാണുക

- അഗ്രി ഗോൾഡ് ലോണിനുള്ള അപേക്ഷ

- അഗ്രി ഗോൾഡ് ലോൺ-സ്വർണ്ണത്തിൻ്റെ മൂല്യം

- അഗ്രി ഗോൾഡ് ലോൺ-കാൽക്കുലേറ്റർ

- കെ വൈ സി, പി ഒ ഐ, പി ഒ എ പൂർത്തിയാക്കുക

- രജിസ്ട്രേഷൻ സമയത്ത് പുരോഗതി ട്രാക്കറിൻ്റെ ഡിസ്പ്ലേ

- പോയിൻ്റ് ക്രെഡിറ്റ്

- പോയിൻ്റുകൾ വീണ്ടെടുക്കൽ

- പോയിൻ്റ് പ്രസ്താവന

- പോയിൻ്റ് കാൽക്കുലേറ്റർ

- ഓഫറുകൾ കാണുക

- റിവാർഡ് കാറ്റലോഗ് ബ്രൗസ് ചെയ്യുക

- സാധനങ്ങൾ / സേവനങ്ങൾ (യാത്രാ ടിക്കറ്റുകൾ ഉൾപ്പെടെ) / വൗച്ചറുകൾ മുതലായവ വാങ്ങുക.

- റിവാർഡ് പോയിൻ്റുകൾ പരിശോധിച്ച് റിഡീം ചെയ്യുക

- എഫ് എ ടി സിഎ പ്രഖ്യാപനം

- ഫോം 15-G/H സമർപ്പിക്കൽ , കാണുക, അംഗീകാരം

- അക്കൗണ്ട് വിശദാംശങ്ങൾ കാണിക്കുക - എം എ ബി, അക്കൗണ്ട് സ്റ്റാറ്റസ്, അക്കൗണ്ട് തരം, ബ്രാഞ്ച്, ഐ എഫ് എസ് സി കോഡ്, വിലാസം തുടങ്ങിയവ

- വ്യത്യസ്ത ഉൽപ്പന്ന തരങ്ങൾക്കായുള്ള ഒറ്റ കാഴ്ച - അക്കൗണ്ടുകൾ, നിക്ഷേപങ്ങൾ, കാർഡുകൾ, വായ്പകൾ

- ഓരോ അക്കൗണ്ടിനും എ ക്യു ബി ബാലൻസ് ട്രാക്കർ പ്രദർശിപ്പിക്കുക

- ചെക്ക് ബുക്ക് അഭ്യർത്ഥിക്കുക

- ചെക്ക് സ്റ്റാറ്റസ് കാണുക, ചെക്കുകളുടെ പേയ്മെൻ്റ് നിർത്തുക

- പോസിറ്റീവ് പേ സിസ്റ്റത്തിൻ്റെ (പിപിഎസ്) വിശദാംശങ്ങൾ സ്വീകരിക്കുക

- മുൻകൂട്ടി പൂരിപ്പിച്ച ഡെപ്പോസിറ്റ് സ്ലിപ്പുകൾ ഡൗൺലോഡ് ചെയ്യുക

- ഉൽപ്പന്ന ആപ്ലിക്കേഷനുകളിലെ പേര്, വിലാസം തുടങ്ങിയ വിശദാംശങ്ങൾ സ്വയമേവ പൂരിപ്പിക്കുക

- ബ്രാഞ്ചിൽ ഡിഡി അഭ്യർത്ഥിക്കുക

- ലൈഫ് സർട്ടിഫിക്കറ്റ് ജനറേഷൻ

- പി പി എഫ് ഓൺബോർഡിംഗ്

- പിപിഎഫ് സംഭാവന

- എസ് എസ് വൈ ഓൺബോർഡിംഗ്

- എസ് എസ് വൈ സംഭാവന

- എൻ പി എസ് ഓൺബോർഡിംഗ്

- എൻ പി എസ് സംഭാവന

- സർക്കാർ സ്കീമുകളുടെ സവിശേഷതകൾ, ആനുകൂല്യങ്ങൾ, ചെലവുകൾ എന്നിവ പ്രദർശിപ്പിക്കുക

- പ്രാരംഭ നിക്ഷേപം/ ധനസഹായം

- പ്രവർത്തന അക്കൗണ്ടിൽ നിന്നുള്ള ഫണ്ട് ട്രാൻസ്ഫറിനുള്ള സ്റ്റാൻഡിംഗ് നിർദ്ദേശം

- നോമിനി രജിസ്ട്രേഷൻ - സിംഗിൾ / മൾട്ടിപ്പിൾ

- യോഗ്യതാ പരിശോധന

- മറ്റ് എൻ പി എസ് അക്കൗണ്ടുകൾ ലിങ്ക് ചെയ്യുന്നു

- ബാങ്ക് ഇ എഫ് ആർ എം സംവിധാനവുമായുള്ള സംയോജനം

ബി ഒ ഐ മൊബൈൽ ഒ എം എൻ ഐ നിയോ ബാങ്ക് ആപ്പ്

സാമ്പത്തിക ശാക്തീകരണത്തിന് തടസ്സമില്ലാത്ത നടപടികൾ...

ബി ഒ ഐ മൊബൈൽ ഒ എം എൻ ഐ നിയോ ബാങ്ക് ആപ്പ്

സ്വയം, ഒന്നുകിൽ അല്ലെങ്കിൽ അതിജീവിച്ചവർ, മുൻ അല്ലെങ്കിൽ അതിജീവിച്ചവർ, ആരെങ്കിലും അല്ലെങ്കിൽ അതിജീവിച്ചവർ, എച്ച് യു എഫ്-നുള്ള കർത്താ, കറൻ്റ് അക്കൗണ്ടിൻ്റെ ഉടമസ്ഥൻ എന്നിങ്ങനെ പ്രവർത്തന രീതിയുള്ള ബി ഒ ഐ-യിൽ അക്കൗണ്ട് ഉള്ള ആർക്കും.

മൈനർ/ സ്വയം പ്രവർത്തിപ്പിക്കുന്ന മൈനർ അക്കൗണ്ടുകൾ ബോർഡിംഗിൽ അനുവദനീയമല്ല അപ്ലിക്കേഷൻ.

ആൻഡ്രോയിഡ് 9 അല്ലെങ്കിൽ അതിന് മുകളിലുള്ളത് /ഐ ഒ എസ് 12.0 അല്ലെങ്കിൽ അതിന് മുകളിലുള്ളത് / മാക് ഒ എസ് 11.0 അല്ലെങ്കിൽ അതിന് മുകളിലുള്ളത്.

മറ്റ് ഫീച്ചറുകളും ഇടപാട് അവകാശങ്ങളും ഉപയോഗിക്കുന്നതിന് ഉപയോക്താവ് സജീവമായ ഡെബിറ്റ് കാർഡ് ഉപയോഗിച്ച് സേവിംഗ്സ് അക്കൗണ്ട് തുറക്കണം.

ഒരു മൊബൈൽ നമ്പർ ഒന്നിലധികം ഉപഭോക്തൃ ഐഡികളുമായി ലിങ്ക് ചെയ്യാൻ കഴിയും. രജിസ്ട്രേഷൻ സമയത്ത്, ഉപയോക്താവ് ഉപയോഗിക്കാൻ താൽപ്പര്യപ്പെടുന്ന കസ്റ്റമർ ഐഡി തിരഞ്ഞെടുക്കാൻ ആപ്പ് ഉപയോക്താവിനോട് ആവശ്യപ്പെടും. തിരഞ്ഞെടുത്ത കസ്റ്റമർ ഐഡിയുമായി ലിങ്ക് ചെയ്തിരിക്കുന്ന എല്ലാ അക്കൗണ്ടുകളും ആപ്പ് പ്രദർശിപ്പിക്കും.

- ആപ്പ് രജിസ്ട്രേഷനായി ഉപഭോക്തൃ മൊബൈൽ നമ്പർ റീട്ടെയിൽ കസ്റ്റമർ ഐഡിയുമായി ലിങ്ക് ചെയ്തിട്ടുണ്ടോയെന്ന് പരിശോധിക്കുക.

- അനുവദനീയമായ പ്രവർത്തന രീതി സ്വയം, ഇ/എസ്, എഫ് എസ്, എ/എസ്, കർത്ത മുതലായവയാണ്.

- സ്വയം പ്രവർത്തിപ്പിക്കുന്ന മൈനർ അക്കൗണ്ടിന് ആപ്പിലെ ബോർഡിംഗ് അനുവദനീയമല്ല.

- അക്കൗണ്ടിലെ ആധാർ, ലിംഗഭേദം, ഡി ഒ ബി വിശദാംശങ്ങൾ ശരിയാണോയെന്ന് പരിശോധിക്കുക.

- ഉപയോക്താവിന് പ്രൊപ്രൈറ്ററി കറൻ്റ് അക്കൗണ്ട് ഉണ്ടായിരിക്കണം.

- ഫിനാക്കിളിലെ അനുബന്ധ പാർട്ടി>എച്ച് എ സി എം എന്നതിൽ ഉപയോക്താവിന് ഒരു റീട്ടെയിൽ കസ്റ്റമർ ഐഡി ചേർത്തിരിക്കണം. ഇടപാട് അവകാശങ്ങൾക്കായി, അതേ റീട്ടെയിൽ കസ്റ്റമർ ഐഡിയുമായി ലിങ്ക് ചെയ്തിരിക്കുന്ന ഒരു സജീവ ഡെബിറ്റ് കാർഡ് ഉപയോക്താവിന് ഉണ്ടായിരിക്കണം.

സ്ഥിരമായ ഇൻ്റർനെറ്റ് കണക്ഷൻ പരിശോധിച്ച് വീണ്ടും ശ്രമിക്കുക അല്ലെങ്കിൽ വൈഫൈക്ക് പകരം മൊബൈൽ ഡാറ്റ ഉപയോഗിക്കുക. പ്രശ്നം നിലനിൽക്കുന്നുണ്ടെങ്കിൽ, BOIMobileSupport@bankofindia.co.in എന്ന വിലാസത്തിൽ ഉപഭോക്തൃ ഐഡിയും റെജിഡ് മോബ് നമ്പറും പങ്കിടുക അല്ലെങ്കിൽ +912240919191 എന്നതിൽ വിളിക്കുക

- ഉപയോക്താവ് മുമ്പ് മറ്റ് ഉപകരണത്തിൽ ആപ്പ് രജിസ്റ്റർ ചെയ്തിട്ടുണ്ടെങ്കിൽ, ഉപയോക്താവ് മുമ്പത്തെ ഉപകരണത്തിൽ ആദ്യം രജിസ്റ്റർ ചെയ്യേണ്ടതുണ്ട്. (പ്രൊഫൈൽ> അലേർട്ട് & മുൻഗണനകൾ> എന്നതിലേക്ക് പോകുക.

- ഫിനാക്കിളിൽ ഉപയോക്താവ് മൊബൈൽ നമ്പർ മാറ്റുകയാണെങ്കിൽ, പുതിയ മൊബൈൽ നമ്പർ ഉപയോഗിച്ച് ഉപയോക്താവ് വീണ്ടും ആപ്പ് രജിസ്റ്റർ ചെയ്യണം.

- ആപ്പുമായി ഒ എസ് അനുയോജ്യമാണോ (ആൻഡ്രോയിഡ് 9 അല്ലെങ്കിൽ അതിന് മുകളിലുള്ളത്, ഐ ഒ എസ് 12.0 അല്ലെങ്കിൽ അതിന് മുകളിലുള്ളത്) എന്ന് പരിശോധിക്കുക. പ്രശ്നം തുടരുകയാണെങ്കിൽ, BOIMobileSupport@bankofindia.co.in എന്ന വിലാസത്തിൽ ബ്രാഞ്ച് കസ്റ്റമർ ഐഡിയും റെജിഡ് മോബ് നമ്പറും പങ്കിടേണ്ടതുണ്ട്.

- ആപ്പ് അതിൻ്റെ ഏറ്റവും പുതിയ പതിപ്പിലേക്ക് അപ്ഡേറ്റ് ചെയ്യുക. ആപ്പ് ഉപയോഗിക്കുന്നതിന് ഉപകരണത്തിന് മതിയായ റാം/റോം ഉണ്ടോയെന്ന് പരിശോധിക്കുക. കൂടാതെ, ആപ്ലിക്കേഷൻ ഉപയോഗിക്കുമ്പോൾ ശക്തമായ നെറ്റ്വർക്ക് ലഭ്യത ഉപയോക്താവ് ഉറപ്പാക്കണം

- .സേവിംഗ്സ് അക്കൗണ്ടിന്: റീട്ടെയിൽ കസ്റ്റമർ ഐഡിയുമായി ലിങ്ക് ചെയ്തിരിക്കുന്ന ഡെബിറ്റ് കാർഡ് സജീവമാണോയെന്ന് പരിശോധിക്കുക.

- നിലവിലെ അക്കൗണ്ടിനായി: ഉപയോഗിച്ച് രജിസ്റ്റർ ചെയ്യുക. പ്രശ്നം ഇപ്പോഴും നിലനിൽക്കുന്നുണ്ടെങ്കിൽ, ഡെബിറ്റ് കാർഡ് മാപ്പിംഗിനായി headoffice.cpddebitcard@bankofindia.co.in-നെ ബന്ധപ്പെടുക.

ക്രെഡിറ്റ് കാർഡ് റീട്ടെയിൽ കസ്റ്റമർ ഐഡിയുമായി ലിങ്ക് ചെയ്തിട്ടുണ്ടോയെന്ന് പരിശോധിക്കുക. പ്രശ്നം നിലനിൽക്കുകയാണെങ്കിൽ, ഉപഭോക്തൃ ഐഡിയും മറ്റ് പ്രസക്തമായ വിശദാംശങ്ങളും headoffice.cpdcreditcard@bankofindia.co.in എന്നതിൽ പങ്കിടുക.

- നിലവിലെ അക്കൗണ്ടുമായി ലിങ്ക് ചെയ്തിരിക്കുന്ന ആപ്പ് രജിസ്ട്രേഷൻ സമയത്ത് ഉപയോക്താവ് റീട്ടെയിൽ കസ്റ്റമർ ഐഡി ഉപയോഗിക്കണം

- ഉപയോക്താവിന് നിലവിലെ അക്കൗണ്ടുകൾ ഇനിപ്പറയുന്ന രീതിയിൽ ലിങ്ക് ചെയ്യാൻ കഴിയും: ഉപഭോക്തൃ പ്രൊഫൈൽ> അക്കൗണ്ടും പേയ്മെൻ്റും> ലിങ്ക് & പ്രാഥമിക അക്കൗണ്ട് സജ്ജീകരിക്കുക.

- ഫിനാക്കിൾ-ലെ എച്ച് എ സി എം> അനുബന്ധ പാർട്ടിയിലെ കറൻ്റ് അക്കൗണ്ടുമായി റീട്ടെയിൽ കസ്റ്റമർ ഐഡി ലിങ്ക് ചെയ്തിട്ടുണ്ടോയെന്ന് പരിശോധിക്കുക.

ആപ്പിൽ ഇടപാട് അവകാശങ്ങൾ പ്രവർത്തനക്ഷമമാക്കാൻ, പ്രൊഫൈൽ > സുരക്ഷയും സ്വകാര്യതയും > മാനേജർ ഇടപാട് അവകാശങ്ങൾ എന്നതിലേക്ക് പോകുക. പ്രശ്നം നിലനിൽക്കുന്നുണ്ടെങ്കിൽ, BOIMobileSupport@bankofindia.co.in എന്നതിൽ കസ്റ്റമർ ഐഡിയും റെജിഡ് മോബ് നമ്പറും പങ്കിടുക അല്ലെങ്കിൽ +912240919191 എന്നതിൽ വിളിക്കുക

ഗുണഭോക്താവിൻ്റെ വിശദാംശങ്ങൾ പരിശോധിക്കുക. പോയിൻ്റ് നമ്പർ 11 റഫർ ചെയ്യുക. സമാനമായ പ്രശ്നങ്ങൾക്ക് ആപ്പിൽ ലഭ്യമായ പതിവുചോദ്യങ്ങൾ പരിശോധിക്കുക. ആപ്പ് തുറക്കുക> പ്രൊഫൈലിലേക്ക് പോകുക (ഡാഷ്ബോർഡിൽ മുകളിൽ ഇടത് മൂല)> പതിവ് ചോദ്യങ്ങൾ.

ബ്രാഞ്ചിൽ ഉണ്ടാക്കിയ ടി ഡി ആർ/എഫ് ഡി ആർ പുതിയ ആപ്പിൽ ക്ലോസ് ചെയ്യാൻ കഴിയില്ല. ബി ഒ ഐ ഒ എം എൻ ഐ എൻ ഇ ഒ/പഴയ ബി ഒ ഐ ആപ്പിൽ നിർമ്മിച്ച എഫ് ഡി ആർ/ടി ഡി ആർ മാത്രമേ ആപ്പിലൂടെ ക്ലോസ് ചെയ്യാൻ കഴിയൂ.

ഡ്യുവൽ/സിമുലേറ്റർ/വി പി എൻ/സ്ക്രീൻ റെക്കോർഡർ ആപ്പുകൾ അൺഇൻസ്റ്റാൾ ചെയ്യുക അല്ലെങ്കിൽ പ്രവർത്തനരഹിതമാക്കുക. കൂടാതെ, ഉപകരണം റൂട്ട് ചെയ്താൽ/ ജയിൽബ്രോക്കൺ ആണെങ്കിൽ ആപ്പ് പ്രവർത്തിക്കില്ല

സുരക്ഷാ ആവശ്യത്തിനായി സ്ക്രീൻഷോട്ട് എടുക്കാൻ ആപ്പ് അനുവദിക്കുന്നില്ല. കൂടാതെ, സ്ക്രീൻ റെക്കോർഡിംഗ്/ഷെയറിംഗ് ആപ്പുകൾ ഉണ്ടെങ്കിൽ, ആപ്പ് ഉപയോഗിക്കുന്നതിന് മുമ്പ് അടച്ചിരിക്കണം.

സിസി അക്കൗണ്ടുകൾ ഉടൻ ആപ്പിൽ ലഭ്യമാക്കും.

ഉപകരണത്തിലെ ഡിഫോൾട്ട് കീബോർഡിനെ മാത്രമേ ആപ്പ് പിന്തുണയ്ക്കൂ.

- ആപ്പ് രജിസ്ട്രേഷൻ സമയത്ത് ഉപയോക്താവിന് ശക്തമായ നെറ്റ്വർക്ക് ലഭ്യത ഉറപ്പാക്കാം.

- ഡിഫോൾട്ട് സിം ഇ-സിം പ്രവർത്തനക്ഷമമാക്കാനും ഉപകരണത്തിലെ ഏത് സിം സ്ലോട്ടുകളിലും ഉപയോഗിക്കാനും കഴിയും

- ആപ്പിൾ ഉപയോക്താക്കൾക്കായി, ഐമെസ്സേജ്-ൽ നിന്നുള്ള ഡിഫോൾട്ട് സന്ദേശമയയ്ക്കൽ എസ് എം എസ്-ലേക്ക് മാറ്റുക

രജിസ്ട്രേഷൻ സമയത്ത്, സിം പരിശോധിക്കുന്നതിന് ഉപയോക്താവ് മൊബൈൽ ഡാറ്റ പ്രവർത്തനക്ഷമമാക്കേണ്ടതുണ്ട്. അതിനുശേഷം, ആപ്പിന് വൈഫൈയിൽ പ്രവർത്തിക്കാനാകും.

അനുയോജ്യതയ്ക്കായി പോയിൻ്റ് നമ്പർ 2 പരിശോധിക്കുക. പ്ലേ സ്റ്റോർ/ആപ്പ് സ്റ്റോറിൽ തിരഞ്ഞെടുത്ത രാജ്യം ഇന്ത്യയാണെന്ന് ഉറപ്പാക്കുക.

ആപ്പ് ഉപയോക്തൃ പെരുമാറ്റം വിശകലനം ചെയ്യുകയും ഉപയോക്തൃ ലൊക്കേഷൻ, ഉപയോഗ സമയം, ഉയർന്ന മൂല്യമുള്ള ഇടപാടുകൾ തുടങ്ങിയവയിൽ എന്തെങ്കിലും അപാകത കണ്ടെത്തിയാൽ അധിക പ്രാമാണീകരണം ആവശ്യപ്പെടുകയും ചെയ്യും.

എം-പിൻ മാറ്റാൻ: ആപ്പ് തുറക്കുക> പ്രാമാണീകരണത്തിനായി എംപിൻ തിരഞ്ഞെടുക്കുക> എം-പിൻ മറന്നു> ഓതൻ്റിക്കേഷൻ രീതി തിരഞ്ഞെടുക്കുക> ഡെബിറ്റ് കാർഡ്> ഡെബിറ്റ് കാർഡ് വിശദാംശങ്ങൾ നൽകുക> കാർഡ് വിശദാംശങ്ങൾ പരിശോധിക്കുക> പുതിയ എം-പിൻ സജ്ജീകരിക്കുക.

- ഏറ്റവും പുതിയ പതിപ്പിലേക്ക് ആപ്പ് അപ്ഡേറ്റ് ചെയ്യുക.

- ആപ്പ് കാഷെ മായ്ക്കുക.

- മൊബൈൽ ഒഎസ് ഏറ്റവും പുതിയ പതിപ്പിലേക്ക് അപ്ഗ്രേഡ് ചെയ്യുക

- ആപ്പ് ഉപയോഗിക്കുന്നതിന് ഉപകരണത്തിന് മതിയായ റാം/റോം ഉണ്ടോയെന്ന് പരിശോധിക്കുക.

- ഉപയോക്താവിന് മതിയായ ബാലൻസ്/തീർച്ചപ്പെടുത്താത്ത എസ് ഐ പി/എൻ എ സി എച്ച്/എസ് ഐ/ ലൈൻ തുക ഉണ്ടോയെന്ന് പരിശോധിക്കുക.

- ഗുണഭോക്താവിൻ്റെ വിശദാംശങ്ങൾ തെറ്റാണോയെന്ന് പരിശോധിക്കുക. അക്കൗണ്ട് പ്രവർത്തനരഹിതമാണെങ്കിൽ/ മരവിപ്പിച്ചിട്ടുണ്ടെങ്കിൽ, പരിഹാരത്തിനായി ഉപയോക്താവ് ബ്രാഞ്ചിനെ സമീപിക്കണം.

- ഇടപാട് പരിധി കവിഞ്ഞാൽ, ആപ്പിൽ ഇടപാട് പരിധി വർദ്ധിപ്പിക്കാൻ ഉപയോക്താവിന് കഴിയും.

ആപ്പിലെ പിശക് സന്ദേശത്തെ അടിസ്ഥാനമാക്കി ഉപയോക്താവിന് നടപടിയെടുക്കാം. പിശക് ഇപ്പോഴും നിലവിലുണ്ടെങ്കിൽ, BOIMobileSupport@bankofindia.co.in-ൽ അക്കൗണ്ട് വിശദാംശങ്ങളും മറ്റ് പ്രസക്തമായ വിവരങ്ങളും പങ്കിടുക

ഉപയോക്താവ് അവരുടെ ഉപകരണത്തിലെ വൈഫൈ അല്ലെങ്കിൽ മൊബൈൽ ഡാറ്റ വഴി അപ്ഡേറ്റ് ആപ്പ് തിരഞ്ഞെടുക്കേണ്ടതുണ്ട്

ഉപയോക്താവിന് പ്രൊഫൈൽ (ഇടത് കൈ മുകളിൽ മൂല)> പരാതികളും തർക്കങ്ങളും പരിഹരിക്കാൻ പോകാം,

- ഐ എം പി എസ് വഴിയുള്ള ഇടപാടിന്: boi.imps@bankofindia.co.in

- എൻ ഇ എഫ് ടി/ആർ ടി ജി എസ് വഴിയുള്ള ഇടപാടിന്: boi.neft@bankofindia.co.in

- യുപിഐ വഴിയുള്ള ഇടപാടിന്: headoffice.dbd@bankofindia.co.in

സാധാരണ ക്രെഡൻഷ്യലുകൾ ഉപയോഗിച്ച് ഉപയോക്താവിന് പുതിയ ഉപകരണത്തിൽ രജിസ്റ്റർ ചെയ്യാൻ കഴിയും, അത് നഷ്ടപ്പെട്ട ഉപകരണത്തിൽ നിന്ന് ആപ്ലിക്കേഷൻ സ്വയമേവ രജിസ്ട്രേഷൻ ഇല്ലാതാക്കും.

ആപ്പ് തുറക്കുക> പ്രൊഫൈലിലേക്ക് പോകുക (ഡാഷ്ബോർഡിൽ മുകളിൽ ഇടത് മൂല)> അക്കൗണ്ടും പേയ്മെൻ്റും> ഇടപാട് പരിധികൾ സജ്ജമാക്കുക.

ഉപയോക്താവ് ശരിയായ ആധാർ, പാൻ, ഡി ഒ ബി, അക്കൗണ്ടിലെ അവസാന 5 ഇടപാടുകൾ എന്നിവ നൽകണം. പ്രശ്നം ഇപ്പോഴും നിലവിലുണ്ടെങ്കിൽ, ബ്രാഞ്ചിലെ എല്ലാ വിശദാംശങ്ങളും അപ്ഡേറ്റ് ചെയ്യുക.

സേവിംഗ്സ് അക്കൗണ്ടുമായി ലിങ്ക് ചെയ്തിരിക്കുന്ന സജീവ ഡെബിറ്റ് കാർഡ് ഉപയോക്താവിന് ഇല്ല

ബി ഒ ഐ മൊബൈൽ ഒ എം എൻ ഐ നിയോ ബാങ്ക് ആപ്പ്

BoiMobileSupport@bankofindia.co.in

ബി ഒ ഐ മൊബൈൽ ഒ എം എൻ ഐ നിയോ ബാങ്ക് ആപ്പ്

The Bank shall recognize and respect intellectual property rights (that include software or document copyright, design rights, trademarks, patents, and source code licenses) associated with its information systems.

The Bank shall comply with:

- Copyright requirements associated with proprietary material, software, and designs acquired by the Bank;

- Licensing requirements limiting the usage of products, software, designs and other material acquired by the Bank.

- Updating the License inventory periodically and the efficient management of the license process.

- Appropriate procedures shall be implemented to ensure compliance with legislative, regulatory, and contractual requirements on the use of material in respect of which there may be intellectual property rights and on the use of proprietary software products.

The Bank shall ensure continued compliance with product copyright restrictions and licensing requirements.

We may provide links to other websites. Within our mobile application/internet banking, there may be embedded applications, plug-ins, widgets, as well as links to third-party sites that may offer you goods, services, or information. Some of these sites may appear within our mobile application/internet banking. When you click on one of these applications, plug-ins, widgets, or links, you will leave our mobile application/internet banking and will no longer be subject to Bank of India privacy policy and privacy practices. We are not responsible for the information collection practices of the other sites that you visit, and we urge you to review their privacy policies before you provide them with any non-public information about you. Third-party sites may collect and use information about you in ways that are different from Bank of India privacy policy. Thus, if you follow links to websites not controlled by the Bank, you take the responsibility of reviewing their privacy policies and other terms and provide your information, as they may be different from our mobile application/internet banking and Bank of India will not be liable for any disclosure of information resulting from such activity.

Customers' personal information should be kept confidential unless they have offered specific consent to the financial services provider or such information is required to be provided under the law or it is provided for a mandated business purpose (for example, to insurance, MF company). The customer shall be informed upfront about likely mandated business purposes. Customers have the right to protection from all kinds of communications, electronic or otherwise, which infringe upon their privacy. In pursuance of the above Right, bank will –

Treat customer's personal information as private and confidential (even when the customer is no longer banking with us), and, as a general rule, not disclose such information to any other individual/institutions including its subsidiaries / associates, tie-up institutions etc. for any purpose unless.

- The customer has authorized such disclosure explicitly in writing.

- Disclosure is compelled by law / regulation.

- Bank has a duty to the public to disclose i.e. in public interest.

- Bank has to protect its interests through disclosure.

- It is for a regulatory mandated business purpose such as disclosure of default to credit information companies or debt collection agencies.

Ensure such likely mandated disclosures be communicated immediately to the customer in writing.

Shall not use or share customer's personal information for marketing purpose, unless the customer has specifically authorized it;

Shall adhere to Telecom Commercial Communications Customer Preference Regulations, 2010 (National Customer Preference Registry) issued by Telecom Regulatory Authority of India, while communicating with customers.

The content to be posted on bank's mobile application/internet banking must be reviewed and approved by General Manager (GM) in charge, of the respective functional department of the Bank.

The Bank shall ensure that information processing resources and associated documentation are reviewed immediately after installation and thereafter on a periodic basis to verify that they are compliant with the security policies and standards.

Archival of data from the live system would be decided by the business owner. Archived data would be preserved and made available easily as and when demanded for a reasonable period of time as decided by the Business owner.

Retention period of data would be decided by the business owner. In no case the retention of data would be less than the period mandated by the regulations relevant to the data.

Data Retention & Archival:

Data (electronic / physical) will be retained and disposed of in an appropriate manner in accordance with Bank's and regulatory Record-keeping guidelines.

The following aspects should be taken into account while prescribing various record preservation periods-

- Compliance with statutory and regulatory requirements.

- Satisfaction of the needs of RBI inspectors to have access to certain records.

- Satisfaction of the needs of internal and external auditors to have access to certain records.

a) Protecting Your Information, Integrity, Confidentiality, and Security

We protect information we collect about you by maintaining physical, logical, administrative, electronic, and procedural safeguards. These safeguards restrict access to your confidential information to only authorized personnel with specific need to access and utilize your information. We train our employees on how to handle your information to maintain confidentiality and privacy. To protect your personal information from unauthorized access and use, we use security measures that comply with law and industry level best practices. These measures include computer and system safeguards, strong access controls, network and application controls, security policies, processes, trained personnel and secured repositories and buildings etc. We regularly monitor and review our compliance with internal policies, regulatory guidelines and industry best practice. We educate our employees to protect the information. The same policy applies to our trusted partners through contracts and agreements.

We take reasonable steps to destroy or permanently de-identify any personal information after which it can no longer be used.

b) Who do we disclose your personal information to, and why? Categories of Third-Parties with Whom Bank of India May Share Information.

Bank of India shares personal information with third-parties only as permitted and required by law, as per Bank’s approved guidelines and your consent in connection with the administration, processing, and servicing of account and account-related transactions, in order to perform services for you and on your behalf, for example, credit reporting agencies, bill payment processors, credit, debit and ATM card processing networks, data processing companies, insurers, marketing and other companies in order to offer and/or provide financial products and services to you, and in response to legal or regulatory requirement, court order and/or other legal process or investigation.

For all third-party outsourcing of services the information is shared and used as per the service level agreement and non-disclosure agreement.

To be more specific the information may be shared with the following:

- our agents, contractors, valuers, solicitors and external service providers;

- authorised representatives and agents who sell products and services on our behalf;

- insurers, re-insurers and health care providers;

- payment systems operators (for example, merchants receiving card payments);

- other organisations, who jointly with us, provide products or services to you;

- other financial services organisations, including banks, mutual funds, stockbrokers, custodians, fund’s managers and portfolio service providers;

- debt collectors;

- our financial advisers, legal advisers or auditors;

- your representatives (including your legal heirs, legal adviser, accountant, mortgage broker, financial adviser, executor, administrator, guardian, trustee, or attorney);

- fraud bureaus or other organisations to identify, investigate or prevent fraud or other misconduct;

- agencies providing credit scores

- Govt. agencies for verification of land records etc

- external dispute resolution schemes

- regulatory bodies, government agencies and law enforcement bodies in any jurisdiction

- we are required or authorised by law or where we have a public duty to do so

- your express instructions or consent to the disclosure with specific entities

- any act or regulation which force us to disclose the information to any specified entity;

- law enforcement and judicial entities

For international transactions, such as currency exchanges, we may need to disclose your information to the corresponding international party in order to process the transaction. The countries we disclose your information to will depend on the details of the transaction you ask us to carry out.

c) Notice and Disclosures

Bank of India will not sell, trade, or disclose the personally identifiable information of its mobile application users to any unauthorized third parties.

d) Data Quality and Access

- Bank of India takes all steps possible to ensure that the data on the mobile application/internet banking is accurate. While reviewing the mobile application/internet banking if something is found to be inaccurate, the Bank will make every effort to correct said information as quickly as possible. If it is found to be an inaccuracy with the entire system, Bank of India will work swiftly to correct the problem so that your web experience is as trouble- free as possible. The information contained on the Bank of India mobile application/internet banking is subject to change without prior advance notice.

While using the Bank of India mobile application/internet banking certain information such as your IP Address and time spent on pages may be collected. This non- personal information is collected in order to monitor any unauthorized use or access to the Bank of India mobile application/internet banking. Anyone caught attempting to harm, steal information from, or otherwise damage the Bank of India mobile application/internet banking will be prosecuted to the full extent of the law.

e) Data Security

- Bank of India takes security very seriously and has therefore taken every precaution to secure our users' information. To secure the user’s information, Bank of India has implemented several security measures to prevent loss, theft, or misuse of any user data.

Bank of India has a Platform Monitoring Plan in place and the mobile application/internet banking is monitored periodically to address and fix the quality and compatibility issues around the following parameters. The parameters such as Performance, Functionality, Crash Reports, API Response Time, and User Engagement Metrics are analyzed to ensure optimal performance.

A feedback mechanism is available within the mobile application/internet banking through a feedback form, allowing users to share their experiences and suggestions. A structured feedback analysis mechanism is also in place to evaluate user input and enhance the mobile application/internet banking based on user suggestions.